STABLE START OF THE YEAR

In USD the fund fell 1.3% in January (EUR: -0.1%), compared to MSCI FMxGCC Net TR (USD) which fell 3.4% and MSCI EM Net TR (USD) which fell 1.1% while MSCI World Net TR (USD) fell 5.4 %. Concerns about rising global inflation and, above all, the US Federal Reserve’s future actions based on this were the main reason for the weak performance in global equities. It also continued to affect our markets. However, the effect was smaller as emerging markets are currently slightly ahead of developed markets regarding the central banks’ actions and concerns about rising inflation are not a new phenomenon in our markets.

An important reason for the fund’s outperformance during the month was our two largest Sri Lankan holdings, the healthcare provider Asiri Hospitals and Windforce Energy with operations in renewable energy. Asiri Hospitals rose 53% during the month. It sounds dramatic but is in our eyes a well-deserved upgrade after the increase in capacity in recent years, which is now also reflected in the results. The company’s profit for the fourth quarter of 2021 (calendar year) increased 63% on an annual basis. On rolling twelve months, the company is now trading at just under 20x the annual profit, which is a valuation more in line with the company’s historical valuation and which reasonably reflects the strong long-term growth opportunities. Windforce rose 10% during the month. We have seen a fairly strong price appreciation for companies in renewable energy in Asia in the past year. The case for renewable energy is significantly stronger in emerging markets as the case there is not primarily about replacing existing power capacity, but above all necessary expansion, where renewable energy (primarily solar energy) is currently often the most rational energy source. It should be remembered that in the wake of rising prices for fossil fuels, the case for renewable energy is further improved. Windforce has a couple of decades of strong growth ahead of it, provided it has the necessary expansion capital. Tundra rarely participates in IPOs, and Windforce was an exception given the strong structural growth case, the strong sponsors and the merited management, as well as the clear societal benefits. The fund currently owns about 5% of the company and we look forward to supporting the company in its continued expansion in the coming decades.

Relative to our benchmark, we also benefited from our underweight in Kazakhstan, where we only own the fintech company Kaspi. The political turbulence in Kazakhstan during the month lowered the market by more than 20%. It also affected our position in Kaspi, which fell as much as 29% in January. We should be able to read some real impact from the unrest in the company’s report for the first quarter. One must also have great respect for this type of event that falls under what we usually call “disruption risks”, I e potential sudden changes in the economy’s ability to function in a way that allows a normal environment for our companies. That is one of the reasons for our relatively limited holdings in Kazakhstan in general. However, we believe that the increased risks are more than well priced in Kaspi in particular and did not change our position during the month.

We were also negatively affected by the correction in Egypt, which comes after a few months of strong price performance. Like Kazakhstan, Egypt is a market where there is a relatively high “disruption risk” given its history. In Egypt, it is primarily state governance issues (state interference in private business) that we are a bit concerned about. This means that one should be humble towards the potential underlying reasons during periods of weakness. As we said earlier, however, we believe that the primary reason for the lack of interest from investors in recent years stems from the high real interest rates (the 5-year bond yield is close to 14% while inflation is around 6%). In our view, the stock market remains abandoned and provided there are no unpleasant surprises, Egypt should be able to be one of the smaller emerging markets with the best conditions over the next two years as tourism globally gradually normalize.

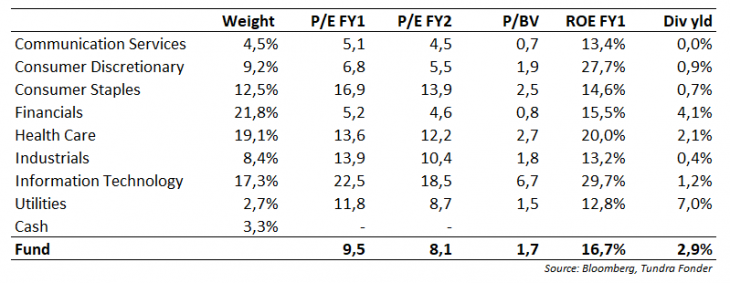

In the short term, global unrest remains the biggest concern and also affects our markets. As we wrote in previous monthly letters, however, our markets are more accustomed to periods of rising inflation, interest rates are already significantly higher today and valuations are in most cases below the average levels from the last ten-year period. At the end of January, the fund’s valuation was just under 10x annual earnings. Based on the current return on equity and the current payout ratio, the portfolio as a whole should be able to generate a recurring profit growth in the range of 12-13% per year in the coming years. Few stock markets around the world today show this characteristic, which means that we are optimistic about being a good complement to a global equity portfolio also in 2022.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.