Sections of website product disclosure for financial products that promote environmental or social

characteristics in accordance with article 10.1 in the regulation (EU) 2019/2088 and the articles 25-36 in the regulation (EU) 2022/1288

Summary

This financial product promotes environmental and/or social characteristics but does not have sustainable investment as its objective. The fund management company verifies that the sustainable investments do not cause significant harm to other sustainable investment objectives by considering the established indicators set out in Annex I to Delegated Regulation 2022/1288/EU. The fund management company is a signatory to the UN Global Compact and commits not to hold investments that violate the ten principles stated.

The fund invests in emerging and frontier markets, with a focus on low-income and lower-middle income countries. Populations in these countries lack fundamental rights such as accessible and qualitative health care, adequate supply of food, decent working conditions and the opportunity to get an education. The lack of basic economic security that characterise these countries provides an opportunity for local companies to play a greater role in the improvement of society. The method chosen by the fund to promote environmental and/or social characteristics is primarily based on ensuring the right of all people to the most basic needs as defined by the UN’s Sustainable Development Goals (SDGs).

The goals of the sustainable investments are to support companies with activities that target sector-specific goals, such as improved food supply, improvements in infrastructure, expansion of renewable energy, increased access to medicines that people can afford, expansion of private health care as a complement to state healthcare, increased access to credit for people and companies, increased access to education and increased integration into the world economy. The fund’s sustainable investments consist of companies that clearly support these goals.

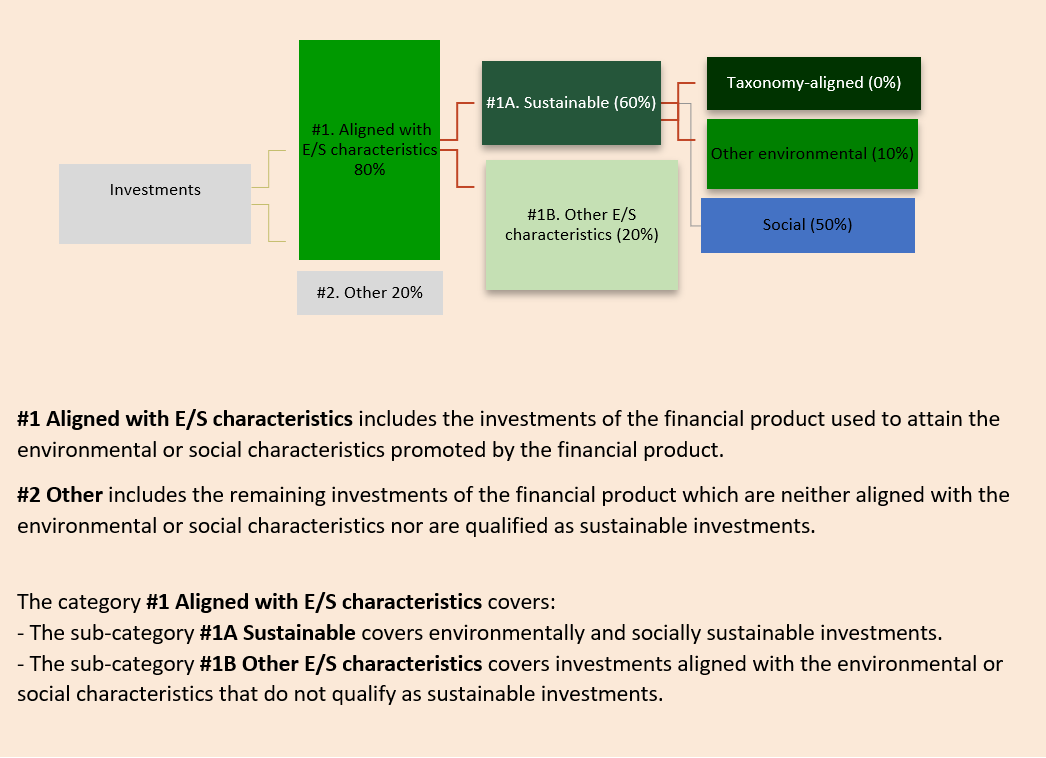

At least 80% of the Fund’s assets shall consist of sustainable investments and investments that meet other environmental or social characteristics. At least 60% of the Fund’s investments shall consist of sustainable investments, of which at least 10% shall constitute environmentally related sustainable investments and at least 50% shall constitute sustainable investments with social characteristics.

The fund management company’s investments are evaluated both by the fund management company’s investment team and by an external consultant (Sustainalytics/Morningstar). The fund management company has also established an internal working group that include members who are independent from the fund management. The working group annually develops a sustainability policy that is approved by the Board. The compliance function regularly follows up the fund management company’s sustainability work and reports to the Board of Directors.

Access to information is generally a challenge in the markets in which the fund invests, as these are not covered by the EU regulations and are relatively far behind more developed markets in terms of maturity. In general, but especially in the fund’s markets, there is always reason to critically review data. All data is handled in strict confidentiality but is documented and can be made available for inspection by the appropriate authority to ensure a representative picture of the fund management company’s work.

The fund management company maintains ongoing dialogues with all portfolio companies as part of our research process. Given the challenges of access to data in the fund’s markets, an important part of our dialogue is to encourage companies to expand on their reporting of sustainability data. The fund management company uses Worldfavor, which is a web-based system where portfolio companies can see what data is requested, report the data that is possible for them to provide and gradually expand their reporting over time. The fund management company holds training seminars that the portfolio companies are invited to, and continuously offers individual technical assistance to the portfolio companies that need support. In the event of controversy and/or established damage to any of the indicators of main adverse consequences, the portfolio company is given the opportunity to take measures to correct such adverse impact within twelve months from the date when the fund management company made the company aware of the issue. In the event the portfolio company clarifies that correction is not intended to be initiated, the investment is disposed of earlier.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have sustainable investment as its objective.

The fund management company verifies that the sustainable investments do not cause any significant harm to other sustainable targets by considering the established indicators set out in Annex I to Delegated Regulation 2022/1288/EU. As the fund invests exclusively in emerging and frontier markets that are not covered by the SFDR, there is currently a lack of reliable data on several indicators under this framework. Currently, our assessment show that only a few of the indicators have sufficient data: Indicator 4 (exposure to companies operating in the fossil fuel sector), Indicator 10 (Violation of the UN Global Agreement and the OECD Guidelines for Multinational Enterprises), Indicator 13 (Gender Equality of the Board) and Indicator 14 (Exposure to controversial weapons). The fund’s ambition is to increase the number of indicators reported by requesting this data directly from the companies. To achieve this, the fund will use the data platform Worldfavor, which is a web-based system where portfolio companies can see what data is requested, report the data that is possible to produce and gradually expand their reporting over time. Among the data requested, information regarding all indicators according to the SFDR (the so-called PAI indicators) are included. The fund management company will have an ongoing dialogue with the companies to promote increased reporting.

The fund management company is a signatory to the UN’s Global Compact and commits not to hold investments that are in violation of the ten principles. Screening of potential breaches is continuous and includes quarterly assessment by external consultant that also review compliance with OECD’s guidelines for multinational companies and the UN’s guiding principles for business and human rights. The fund management company’s internal ESG-analysis (Tundra ESG Spectrum) includes assessment of portfolio companies’ adherence to other aspects of these guidelines such as; the treatment of workers, including union problems, wage conditions and equal treatment. Furthermore, environmental risks, the pursuit of improvement in terms of environmental impact and the development of environmentally friendly technologies are assessed.

Environmental or social characteristics of the financial product

The fund invests in emerging and frontier markets, with a focus on low-income and lower middle-income countries. Populations in these countries lack fundamental rights such as accessible and qualitative health care, adequate supply of food, decent working conditions and the opportunity to get an education. The lack of basic economic security that characterise these countries provides an opportunity for local companies to play a greater role in the improvement of society. The method chosen by the fund to promote environmental and/or social characteristics is primarily based on ensuring the right of all people to the most basic needs as defined by the UN’s Sustainable Development Goals (SDGs).

Environmental characteristics promoted by the fund include the expansion of renewable energy, responsible production and consumption, responsible management of water, improved waste management, and measures to reduce climate impact.

Social characteristics that the fund promotes include reduced poverty, increased access to nutritious food, increased employment with responsible employers, increased access to affordable medicines, expansion of private health care to relieve the burden on state care, increased access to credit for people and companies, increased access to education, gender equality in company boards and management teams, equal treatment of employees, as well as contributions to the country’s increased economic integration globally.

Investment strategy

The fund excludes companies that contribute negatively to the following characteristics:

Environmental characteristics:

The fund does not invest in companies whose turnover of more than 5% comes from:

- Fossil fuels (oil, gas, coal) (Extraction 5%)

- Uranium (recovery 5%)

- Genetically modified organisms (GMOs) (5%)

Social characteristics:

- The fund does not invest in companies with ongoing violations of the UN Global Compact and the OECD Guidelines for Multinational Enterprises that did not initiate action to solve the issue within twelve months of being notified by the fund management company

The fund does not invest in companies whose turnover of more than 5% (in some cases 0%) comes from:

- Cluster bombs, anti-personnel mines, chemical and biological weapons, nuclear weapons (Production/Distribution 0%)

- Other weapons and/or munitions (Production/Distribution 5%)

- Alcohol (production/distribution 5%)

- Tobacco (Production 0%/Distribution 5%)

- Commercial gaming operations (Production/Distribution 5%

- Pornography (Production 0%/Distribution 5%)

The fund includes companies that contribute positively as follows:

The financial product further promotes environmental and social characteristics by investing in companies whose operations are considered to have a long-term positive impact on the society in which the business is conducted. This assessment begins with an evaluation using Tundra’s internal ESG system (Tundra ESG Spectrum). The system currently consists of 58 points of measurement (this number may be increased), divided into environmental characteristics, social characteristics and corporate governance where the company must achieve a minimum goal fulfillment in each subsection to be considered as investable. The system is based on the UN SDGs, which the fund management company has divided at indicator level into two categories: “General” and “Sector-specific“. The following SDGs have been selected as General, which each company in the fund should strive for: SDG5 (Gender Equality), SDG10 (Reduced Inequality) and SDG16 (Peace, Justice and Strong Institutions) constitute social goals, while goals SDG12 (Responsible Consumption and Production) and SDG13 (Climate Action) constitute environmental goals.

Sector-specific environmental targets are considered to be SDG6 (Clean Water and Sanitation), SDG7 (Affordable and Clean Energy), SDG11 (Sustainable Cities and Communities), SDG14 (Life below Water) and SDG15 (Life on Land). Sector-specific social goals are here listed as SDG1 (No poverty), SDG2 (Zero hunger), SDG3 (Good health and Well-being), SDG4 (Quality Education), SDG8 (Decent Work and Economic Growth), SDG9 (Industry, Innovation and Infrastructure) and SDG17 (Partnership for the goals).

A company is considered to comply with the fund’s minimum requirements and can be classified as a sound business if they meet the following: i) they do not violate the sector exclusions as set by the fund, ii) they achieve at least basic level regarding both environmental and social goals iii) they achieve at least satisfactory level of corporate governance.

Companies that, in addition to the above requirements, meet the following: i) conduct a business where more than 50% of the turnover supports one, or more of the sector-specific goals, or: ii) a majority of the investments are made in activities that support one or more of the sector-specific goals, are considered by the fund to be a sustainable investment. This is provided that the investment does not seriously harm any of the Principal Adverse Impact Indicators.

However, in the event of a confirmed damage, the fund management company allows the company twelve months to take measures to correct such a damage. In the event that the company clarifies that correction is not intended to be initiated, the investment is disposed of earlier. Furthermore, the fund management company may in some cases hold ownership in companies with fossil-fired power generation, provided that the company’s expansion investments take place in renewable energy and the company does not carry out expansion investments in fossil-fired power generation.

Proportion of investments

Monitoring of environmental or social characteristics

The fund management company’s investment team continuously monitors portfolio companies, and the work is documented in the fund management company’s internal ESG system (Tundra ESG Spectrum). In addition to our internal analysis, the fund management company also uses external analysis for screening the portfolio on a quarterly basis through the consultant Sustainalytics/Morningstar. In order to establish the framework for the sustainability work conducted, the fund management company has internally established a working group for sustainability. The working group includes employees who work independently from the administration. The working group annually develops a sustainability policy that is confirmed by the Board. The compliance function regularly follows up the fund management company’s sustainability work and reports to the Board of Directors.

Methodologies

Sector exclusions are measured both by our own analysis and through an external quarterly screening conducted by Sustainalytics/Morningstar. Through the fund management company’s internal ESG system (Tundra ESG Spectrum), the company’s operations are evaluated based on both environmental and social characteristics.

Data sources and processing

As the fund invests mainly in markets that are not covered by the EU regulatory framework, a majority of the data used in analysis is expected to be estimated.

The fund management company uses a large number of data sources in its internal analysis. These include, among other things, obtaining information from the companies’ websites and other information that the company publishes, analysis carried out by local brokers and information from the stock exchanges in the countries where the fund invests. In addition, external analysis sources for data are used: Sustainalytics/Morningstar, AML/KYC/Adverse media screening conducted by Trapets, Worldfavor (data collection from portfolio companies) and the information system Bloomberg.

In general, but especially in the fund’s markets, there is reason to critically review data. The fund management company manages this risk by using a variety of sources and striving for all data to be verified with a reasonable probability. The collaboration with Worldfavor should be particularly mentioned as this will be an important tool to persuade companies in the markets where the fund invests to understand what data European investors expect from them and thus in the long run expand access to verifiable information. All data is handled in strict confidentiality but is documented and can be made available for inspection by the appropriate authority to ensure a representative picture of the fund management company’s processes.

Limitations to methodologies and data

Access to information is a general problem in the markets in which the fund invests, as these are not covered by the EU regulations and are relatively far behind more developed markets in terms of maturity. The fund management company’s analysis is carried out by an investment team with extensive experience in analyzing companies in the fund’s markets and normally a large number of sources are used to compile the information collected, but there is still a risk that the data the investment team assumes is not correct.

As the fund management company evaluates all portfolio companies with the same internal ESG system, the fund management company’s ability to detect abnormal data is improved. The fund management company’s collaboration with Worldfavor takes place with the aim of further improving access to data from all portfolio companies. Furthermore, the internal analysis is supplemented with external analysis, which improves the possibility of detection of problems, as well as reduces dependence on individual sources.

Due diligence

The fund management company relies both on its own analysis, which is based on Tundra ESG Spectrum, as well as external analysis with screening conducted by Sustainalytics/Morningstar, as well as screening for AML, KYC and negative publicity (Adverse media) through Trapets in its due diligence process. This creates a duality that allows the fund management company to capture problems in the portfolio from several different sources and through different approaches.

Engagement policies

The fund management company maintains ongoing dialogue with all portfolio companies as part of our research process. The research is based on our internal analysis of their businesses which is documented in the Tundra ESG Spectrum. However, since the companies in which one invests are active in geographies that are not covered by EU regulations, large parts of the data available to European companies are missing. An important part of our dialogue is therefore to engage the companies to expand their reporting of sustainability data. The fund management company uses Worldfavor, a web-based platform where portfolio companies can see what data is requested, report the data that is possible for them to provide and gradually expand their reporting over time. The fund management company holds training seminars which the portfolio companies are invited to, but also continuously offers individual technical assistance to the portfolio companies that request support. This work is followed up continuously. For the portfolio companies, this provides an opportunity to increase their competitiveness in the European market, both towards potential customers who buy their products, but also towards European investors who in the long run will ask the same questions.

In the event of a controversy and/or established damage to any of the indicators of main adverse consequences, the fund management company allows the company twelve months to take measures to correct such damage, from the time when the fund management company brought the matter to the attention of the company. In the event that the company clarifies that correction is not intended to be initiated, the investment is disposed of earlier.

Policies and documents

Sustainability Policy

Annex II_SFDR_Tundra

Annex IV_SFDR_Tundra

Remuneration policy

Tundra PAI Statement

RISK INFORMATION

Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return.

The Full Prospectus, KIID etc. can be found at Buy/Sell and the Annual and semi-annual reports can be found at Annual Reports. You can also contact us to receive the documents free of charge. Please contact us if you require any further information:+46 8-55 11 45 70.