THE FUND:

The fund lost 2% in December, outperforming the benchmark, MSCI EFM Africa ex South Africa Net Total Return Index which decreased 3.3%. After a strong start in 2018 with the fund peaking at more than 22% early May, the markets turned more negative and the fund closed the year at -3.5%. Despite this, it remains the best performing daily traded Africa fund globally. It also beat out the benchmark which retreated 5.2%.

December’s outperformance came mainly from the underweights in Kenya (0% of assets) and Morocco (0%). Egypt (52%) also added to the outperformance. The overweights in Botswana (3% of assets) and Nigeria (32%) made the biggest negative contribution to the relative return. On a sector level, the fund gained from underweights in Consumer Staples and stock picks in Financials. The largest negative contributions relative the benchmark came from overweights in Consumer Discretionary and underweights in Materials. The Swedish Krona appreciated by 1.6% vs the USD in December reducing the SEK return in the month.

In 2018, Egypt was again the main positive contributor to the outperformance where we had a positive return although the market fell. The decision to stay underweight in Kenya also paid off nicely while our big overweight in Nigeria decreased the relative return marginally.

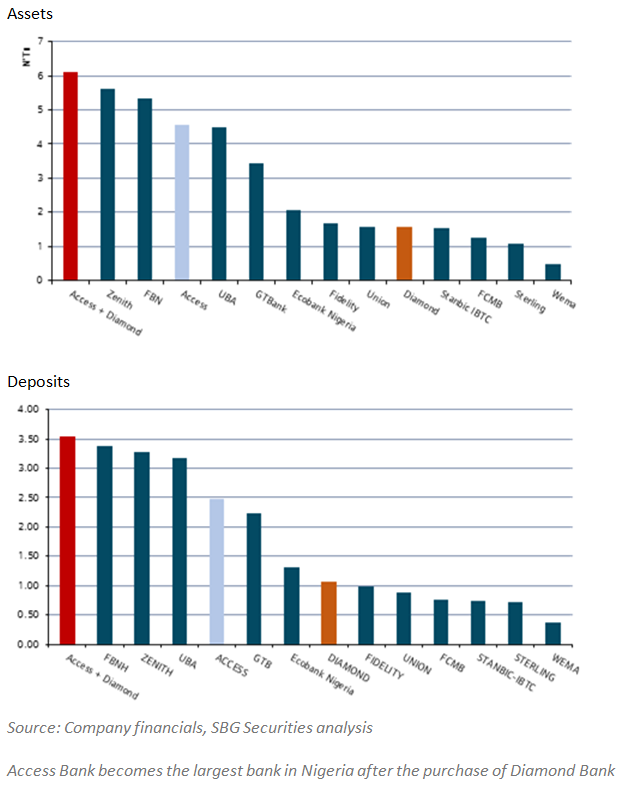

Our latest addition to the fund, education provider Cairo Investment & Real Estate Development (for more information please read our November update), was the best performing holding in December. During the month, we also decreased our exposure in EIPICO and IDH, both Egyptian pharmaceutical companies. We also halved our position in Nigeria’s Access Bank after the company announced its acquisition of competitor Diamond Bank. The deal makes sense creating the largest bank in Nigeria in terms of deposits and loans, but the USD 200m price tag was a little steep considering that assets were valued at USD 50m before the announcement. Furthermore, there are a lot of questions regarding credit quality in the portfolio. We decreased our position in Access Bank when the stock initially surged after the announcement. It later fell back and finished December 13.5% lower than at the end of November. (all changes in SEK)

THE MARKET:

The African markets (MSCI EFM Africa xSA -3.3%) performed better compared to other Frontier Markets (-5.8%) in December. BRVM (a joint exchange for e.g. Senegal, Ivory Coast and Benin) was the best performing market in Africa in December (+5.9%) while Botswana and Kenya were the worst performers (-9.3% and -6.5% respectively).

Top performers in 2018 were were Zimbabwe (+116.9%) and Malawi (+43.7%), where the first rose dramatically due to the ongoing economic crisis where investors sought to hedge themselves from potential hyperinflation and cash crunch; while the latter only has 12 listed stocks with very low turnover. The worst performers in 2018 were Botswana and BRVM falling 31.6% and 22.1% respectively.

Weak markets on the continent have made valuations quite attractive for long term investors. The benchmark for the fund, MSCI EFM Africa xSA, now trades around 7.5x 2019 estimated earnings, and the two main markets of current fund investments, Egypt and Nigeria, are trading approximately 30% lower than a year ago at 6.7x and 6.1x estimated 2019 earnings. The aggregated multiple for the fund is 6.3x estimated earnings, which are expected to grow by 10% in 2019. We see limited downside in the current environment, but also acknowledge that the global risk appetite will have a larger impact in the near term as opposed to attractive valuations.

Egypt’s market (-3.7% in December) fell after continued profit taking, although most news flow were positive. Inflation fell from 17.7% in October to 15.5% in November. The central bank kept interest rates on hold as expected at the last meeting of the year. Egypt announced that all fuel subsidies would be removed by September 2019, which should further improve the government’s finances. Strong evidence of the high quality of many Egyptian companies is the record order awarded to El Sewedy’s, an industrial company, (approximately 4% of assets in the fund) from Tanzania. The company will be part of a USD 2.9bn hydroelectric power station and dam project where El Sewedy’s part amounts to USD 1.3bn. The project will be completed in 3 years following a 6 month preparation period. The stock rose close to 7% after the announcement.

The stock market in Nigeria (-1.8%) rose in local currency but due to the appreciation of the SEK it fell when converted to SEK. The MTN story seems to have reached an end as the company appears to have reached an agreement with the central bank paying a fine of USD 50m to Nigeria as compared to the original claim of USD 8 bn. However, the process has harmed the perception of doing business in Nigeria, which it will take the country several years to recover from.

Kenya (-6.5%) was one of the worst performing markets in Africa as several of the index heavy fell without any news or warning. In November, inflation rose marginally (5.7%) from 5.6% in October. The GDP for the third quarter rose 6%, in line with expectations but lower than the 6.3% achieved in the second quarter.

DISCLAIMER:

Capital invested in a fund may either increase or decrease in value and it is not certain that you will be able to recover all of your investment. Historical return is no guarantee of future return. The Full Prospectus, KIID etc. are available on our homepage. You can also contact us to receive the documents free of charge. Please contact us if you require any further information: +46 8-5511 4570.

Kundgrupp / Investortype:

* Ontario and Quebec