BANGLADESH AND VIETNAM HELPED THE FUND IN SEPTEMBER

The fund rose 1.8% in USD during September (EUR: +3.8%) compared to the benchmark index, MSCI FMxGCC Net TR (USD) which rose 0.8% (EUR: 2.8%) and MSCI EM Net TR (USD) which fell 4.0% (EUR: -2.0%). During the month, we had positive contributions mainly from Bangladesh and Vietnam. Bangladesh makes up 11% of the fund and our portfolio rose just over 9% (USD) during the month. Vietnam makes up just over 20% of the fund and our sub-portfolio rose 3% during the month. Among negative contributions was Kazakhstan, where our position in Kaspi fell just over 7% during the month. In September, we increased our position in the company, from under 2% to 3.5% of the fund’s assets. Among the markets in which the fund is invested, Sri Lanka (+9%), Bangladesh (+6%) and Morocco (+4%) performed the strongest. The weakest markets were Pakistan (-7%), the Philippines (-2%) and Vietnam (+1%). It was a rather turbulent month in global equity markets. Both MSCI World Net TR (USD) and MSCI EM Net TR (USD) fell 4% in the global turmoil. Sharply rising energy prices, especially gas prices, meant an increasing discussion about the inflationary outlook not only in the short term, but also in the medium term. As the world recovers from COVID-19, demand has picked up at the same time as supply has not really caught up in most areas. This creates upward price pressures which are seen in global inflation statistics. Much of the global debate is about how lasting these price increases will be (transitory or not). Depending on the interpretation, it may have an impact on the central banks’ actions, which is a common risk for global equity markets.

In our markets, Sri Lanka has already raised interest rates for the first time. In September, Pakistan’s central bank also raised the key interest rate. In Pakistan, concerns about the rising current account deficit and higher inflation put pressure on the Pakistani equity market in September. However, as long as the central bank allows the currency to weaken, thereby compensating for the growing demand for US dollars, we are not very concerned. A lower exchange rate means an increased competitive advantage for locally produced goods and, in cases where replacement goods do not exist, cools off demand for imports. What we generally do not want to see, however, is the combination of rising current account deficits and declining reserves as this is a sign that the central bank is spending reserves to protect its currency. A hopeless task in 99 cases out of 100.

When we look at macro-specific risks in our countries, our focus is mainly on what we refer to as “disruption risks”, i e the risks of sudden and unexpected shocks to the economy. It is important to understand that traditional risks in our markets such as poorly developed infrastructure, electricity shortages, corruption, security and currency movements are areas that our companies have routines for and are used to managing. Skilled companies even learn to use these to improve their competitive advantage. What we think one should be vigilant about in frontier markets and smaller emerging markets are signs that imbalances are building up in the economy, for example through an overvalued currency which a country tries to protect, or risks of a significantly changed political agenda. Economic imbalances are corrected in the long term, but if they have been built up over a long period of time, they can create significant turbulence in the short term when they unfold. This means risks of interruptions in the companies’ operations and thus constitute problems even for well-managed companies.

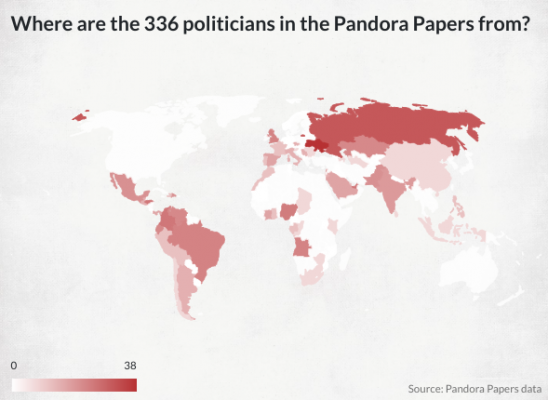

As we write this monthly letter, the “Pandora Papers” has just been released. In the same way as previous “Panama papers”, it is about the disclosure of the underlying owners of a large number of offshore companies. Political implications in any of our markets should not be ruled out, but, as always, it is ultimately about what is revealed and how this is subsequently handled by local authorities.

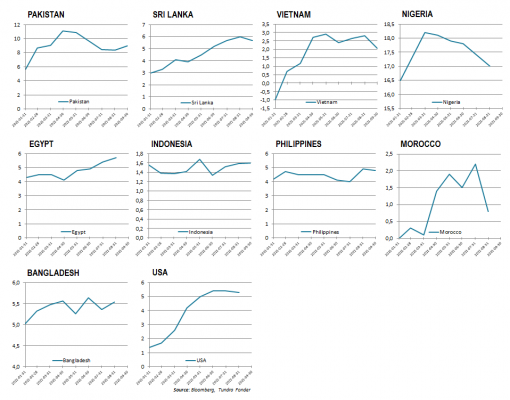

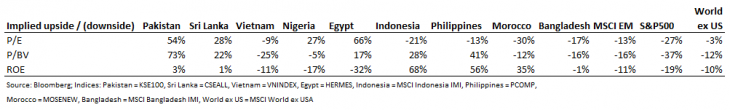

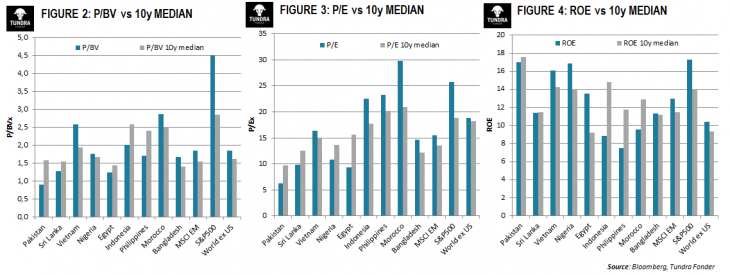

The valuations in our markets remain attractive (see Table 1). Below we show the current P/BV-valuations relative to each market’s 10-year median valuation (see Figure 2). As can be seen, valuations in most of Tundra’s markets are historically low vs history. We also show a corresponding comparison on P/E- valuations (see Figure 3). Here, too, we note that valuations in most markets are historically low. We conclude these with a comparison of what the return on equity looks like today relative to history (See Figure 4). The reason for this is that an abnormally high return on equity can mean that the market does not really believe that profitability (and thus profits) are sustainable and therefore are not willing to pay historical valuations. Here too (Indonesia and the Philippines being the exceptions) we see that the return on equity is in line with historical returns.

We believe that the biggest risk in the short term is a major global downturn in equity markets. No market will be immune to a global equity market crash, but overall we believe that our markets have a good cushion to the risk of falling earnings and a lower risk appetite. Our markets, and perhaps even more so our companies, have so far this year shown that during periods of normal turbulence they can perform relatively well. The fund’s valuation for the current year’s profits (primarily end of year 2021 but parts of the companies’ tax year ends 30/6 2022 and some companies 31/3 2022) is P/E 10x and for the following year 8.3x. The fact that we completely lack energy companies and other cyclical sectors such as steel and cement means that we have relatively good transparency in the earning estimates. We remain constructive to the fund’s future prospects.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.