INFLATION, RATE HIKES, CURRENCY WEAKNESS – A TOUGH MONTH

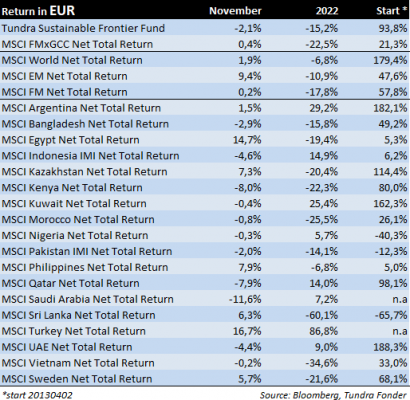

The fund rose 2.8% in USD (-2.1% in EUR) in November, underperforming our benchmark MSCI Frontier Markets ex GCC Index move of +5.5% in USD (+0.4% in EUR). Year to date the fund is still ahead of the benchmark with approx. 7%-points.

On a country level, the largest positive relative contributions came from the Philippines and Pakistan (+1,0%-point and +0,80%-points respectively) while the largest negative relative contributions came from Vietnam -1.35%-point contribution.

Looking at company level Pakistani IT-company Systems Ltd contributed the most after rising 11% (USD). Systems is a long-term holding of the portfolio and has been one of the top three holdings in the portfolio for some time now, reflecting our strong belief in the company. We believe it is still undervalued, trading at 16.5x 2023E earnings. The company benefits from having access to high quality consultants based in Pakistan (and hence PKR-based costs) and the majority of customers paying in USD. Any currency devaluation thus increases revenues, but not costs to the same extent. Increasing exports as well as creating higher value exports is also a priority for the government, making Systems Ltd strategically important for the country.

Our largest negative relative contributions came from Vietnamese companies REE and Mobile World, which declined 6% and 14% (USD) respectively. The Vietnamese market is still experiencing a lot of volatility due to the uncertainties in the property sector (see last month’s update for more details.)

Last month we visited our portfolio companies in Sri Lanka. As we have covered in previous monthly updates the country has gone through a major crisis during 2022. The newly elected President Ranil Wickremasinghe, who took over on July 20th 2022 after Gotabaya Rajapaksa was forced to resign, has his hands full of issues, from electricity outages to USD shortage, current account deficit and spiraling debt servicing costs to name a few.

Since July the road ahead has become clearer and ongoing discussions with both the IMF for a support package and international debtors about restructuring the outstanding debt are ongoing and crucial for the economy to get back on track. The main purpose of our visit was hence to 1) try to gauge the support for the IMF negotiations/debt restructuring and 2) face-to-face meetings with our holdings to see how they are handling the current situation.

We were able to meet high level representatives from the Sri Lankan government and business society, including the Central Bank governor Mr. Weerasinghe, leading economist, and former CB governor Dr. Coomaraswamy, head of SOE restructuring Mr. Shah, and most importantly President Wickremasinghe. The main takeaways are that Sri Lanka understands the problems they have at hand, and current leadership is committed to undertaking necessary reforms to create a stronger economy going forward. The first step towards this is to get the international debt restructuring and IMF deal in place, and then start the ambitious reform agenda including divesting from state assets. We do feel that an understanding of the urgency is there but believe that the market wants to see more progress before rewarding the ambitious program ahead.

We also met management representatives of all our Sri Lankan holdings, as well as visiting some of their manufacturing facilities. From the discussions with management, we can conclude that times are difficult. They believe that the worst point is behind us, but there is a lot depending on the IMF/debt restructuring. The companies have all dealt with cost inflation, weak demand, raw material supply issues, etc., and had to adapt their businesses accordingly.

One of our holdings, Sri Lanka’s largest food conglomerate Cargills PLC, has worked with local sourcing for several years, but has intensified the ambition lately. One example is that they use raw milk instead of imported milk powder in their milk, yoghurt, and ice cream production facility. Cargills has set up 37 chilling centers around the country, sourcing 185 000 liters of milk from more than 15 000 suppliers (small farmers, coops, and farming societies) on a daily basis, injecting LKR 800-900m (USD 2.2-2.5m) per month into the local community. The company is now looking at improving the supply chain for meat producers in a similar way.

Sri Lanka’s renewable energy producer, Windforce has not abandoned their ambition to expand their renewable energy portfolio but are reviewing projects based on the adjusted tariffs set to come shortly. They also have an exciting new venture into electric vehicles (EV), where they initially will sell EV-conversion kits to make existing 3-wheelers (tuk-tuks) into electric ones. By offering financing help, the investment will be cashflow positive from day one. They are also planning to start the assembly of electric motorbikes and 3-wheelers to help reduce petrol consumption (a drain on FX reserves) as well as use a more sustainable energy source for transportation. We left Sri Lanka feeling comfortable with the new government’s intentions and our holdings’ ability to handle the challenges in a suitable way, while still acknowledging that there are some very important hurdles on the way back to recovery.

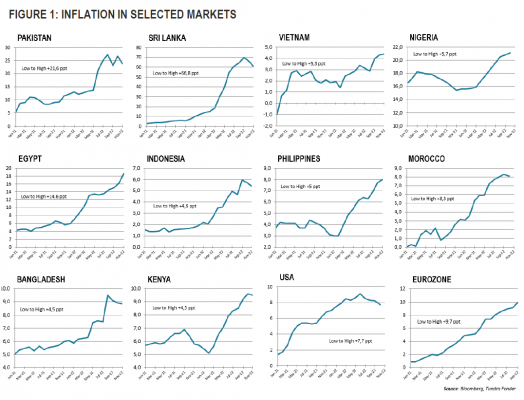

In Pakistan, we saw a surprise move by the central bank to increase the policy rate by 100 bps to 16%. The decision came on the back of strong and persistent inflationary trends within the economy than was earlier expected. The central bank expects inflation in the current fiscal year to average between 21-23% vs. its earlier forecast of 18-20%. However, the central bank maintained its GDP growth projections at 2%. Moving into December, the headway on the 9th review of IMF’s EFF program would remain a key sentiment driver for the market, given the low FX reserves and weak external account position of the country. So far, Pakistan and the IMF failed to evolve a consensus on the post-flood revenues and expenditure plans. The unwillingness on the government’s part to impose additional taxes to bridge gaps with the IMF is likely due to the fact that the country is moving toward the election year.

Most of our markets, as well as most countries globally, are dealing with inflation pressure, rising interest, and currency weakness not seen in a very long time. Countries engaging in too “populistic” measures are punished forcefully by the capital markets (lex UK). Countries running budget deficits and/or current account deficits, and not perceived as dealing with it in a prudent manner, are also feeling increased pressure, be it Egypt, Pakistan, or Sri Lanka. The road ahead is bumpy, and while inflation isn’t really an effect of excessive demand, but rather lack of supply, local rates need to be raised to follow US rate hikes in order for currencies not to devalue further, and hence increase the cost for imported goods and services. Rising rates will have a dampening effect on economic growth which will in turn hurt employment and consumer spending power.

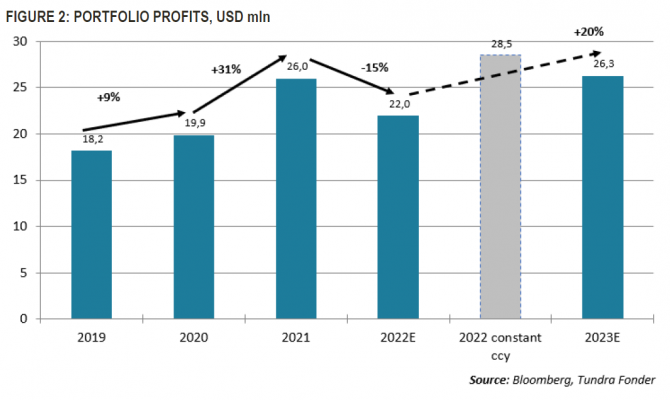

While the current economic hardship is unquestionable and the road to recovery will be bumpy, we feel comfortable about our portfolio holdings. One of the key things we look for is that our holdings should have a proven track record over a longer period of time, in good times as well as in bad times. We expect 2022 profits among our holdings to grow about 10% in local currency, but due to the extraordinary currency weakness across the board, they will decrease by 15% in USD, before returning to historical average of 15-20% (in USD) from 2023 and onwards (see Figure).

That means current valuations and market conditions are too depressed and it will likely be a good time to invest for patient investors. There is a lot of uncertainty and before the market has seen the peak of US inflation and rate hikes, we expect markets to stay in “risk off-mode”, but as we get nearer to that point (expected in Q1’23 by consensus) we believe cheap, high quality growth companies will come back in style again.

______________________________________________________________________

TUNDRA SUSTAINABLE FRONTIER FUND REPLACES THE SWAN WITH THE EU’S REGULATIONS FOR SUSTAINABILITY

In connection with the new EU regulation under the Sustainable Finance Disclosure Regulation (SFDR), new requirements are applied to funds’ sustainability work as of March 2021. Tundra has therefore decided on July 4 not to continue with the Nordic Ecolabelling of the fund. According to the new regulations, sustainability reporting must take place in a uniform manner and funds are divided into different categories. The Tundra Sustainable Frontier Fund is classified as an Article 8 fund (Light green: promotes environmental or social characteristics). The investment philosophy of the fund remains the same; management of the fund and is not affected by the change.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.