WEAK END OF THE YEAR BUT REASON FOR OPTIMISM AHEAD

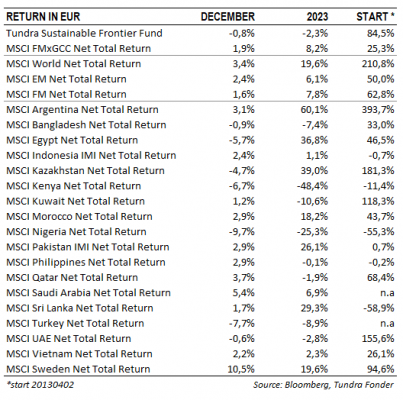

In USD the fund rose 1.2% (EUR: -0.3%) during December, compared to MSCI FMxGCC Net TR (USD), which rose 3.4% (EUR: +1.9%), and MSCI EM Net TR (USD), which rose 3.9% (EUR:+2.4%). During the month, the USD weakened by 1.5% against the EUR.

During a relatively quiet month, the only significant negative portfolio contribution came from Kazakhstan (-0.5% absolute portfolio impact), where our holding in the fintech company Kaspi fell 10% in December. The largest positive contribution came from Vietnam (+0.7% portfolio contribution), where both our consumer companies, Masan Group and Mobile World, rose more than 10%. Among individual holdings, our second largest holding, Pakistani IT company Systems Ltd was the largest negative contributor on the stock level (-0.5% portfolio contribution) as it fell 7% during the month. Systems Ltd is one of our historically most successful holdings but has had a tough time in 2023. The stock fell 29% (USD) in the year, compared to the KSE100 index which rose 24%. There are primarily two factors behind it: The company benefits from a weaker rupee as most of the costs are in Pakistani rupees, and most of the income is in foreign currency. Since August, the Pakistani rupee has strengthened by 10% vs the USD. The share thus did not keep up with the rest of the market in the strong relief rally that began towards the end of the summer. The second factor is pressure on operating margins, which is attributed to the company’s international expansion. It should also be said that despite the weak performance in 2023, the stock has given a total return of 404% in USD over the last 5 years, compared to the KSE100 index, which has fallen 17% during the same period. The valuation has now come down to approx. 14x 2023’s expected profit, with an expected profit growth of approx. 20% in 2024. The company maintains its position as one of those in the portfolio we believe in the most in the coming years, even if the execution will come in phases.

2023 IN SUMMARY – A DIFFICULT YEAR, WITH SPARKS OF LIGHT

When we sum up the year, we note that for the third time in 11 years, we have not beaten our benchmark. Whichever direction you as a manager choose, we believe it is important to have a clear theme. Tundra’s definition of frontier markets has always been and remains what the World Bank defines as low-income and lower-middle-income countries. This is a group of countries we strongly believe in long-term, and they deserve our patience given their superior long-term growth potential. However, our thematic focus has been facing strong headwinds for almost two years now as several of our countries have gone through their worst crises in over 30 years. In 2023, most other equity markets produced higher returns. Underweight or lack of exposure in countries such as Romania, Kazakhstan, Morocco, and Slovenia cost the fund 10% in relative returns versus our benchmark in 2023. But we have also had some problems with our stock selection during the year. Our position in Media Nusantara has cost just under 3% in absolute and relative return during the year. A weak advertising market, amplified by the local transition to digital boxes, has worsened their traditional Free-to-Air advertising business, while investors have not been willing to attach any value to their digital business, which is the main reason for our interest in the company. We also had a weak year in Vietnam. After the very strong 2022 (30% excess return against MSCI Vietnam), our sub-portfolio underperformed the index constituents by 5%, which at the portfolio level cost 1.5% versus our benchmark. Although Pakistan recovered and closed the year in positive territory, our sub-portfolio underperformed the index constituents by 4%, mainly due to weak performance for Systems Ltd (see above). Our Sri Lankan portfolio performed well in 2023, rising 48% compared to 33% for the corresponding index constituents, adding just below 3% absolute and relative return during the year. We also did well in Nigeria, where our sub-portfolio rose 20% while the index constituents fell 22%. The positive return, despite the currency devaluing 53% vs the USD, is a good example of our portfolio companies’ resilience in difficult times. This added 1.8% excess return against our benchmark on the portfolio level.

PORTFOLIO COMPANIES’ PERFORMANCE – ONE STEP BACKWARD, TWO STEPS FORWARD

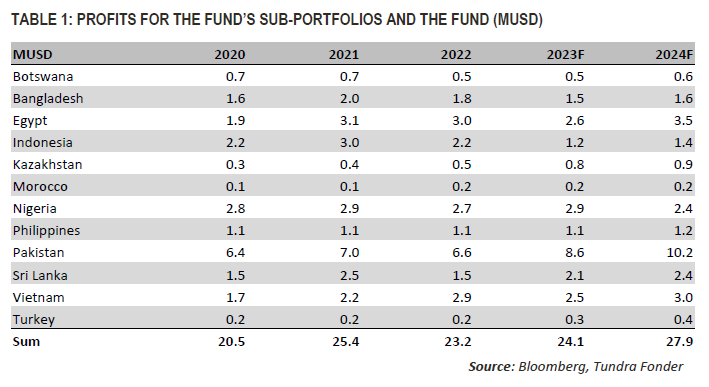

Greed and fear are key factors for short-term performance, but in the long term, share prices are determined by profit growth (i.e., growth in cash flow generation). When we look at the financial performance of our portfolio companies, we note that they have weathered the crisis very well despite the worst possible conditions. For 2023, aggregate earnings for the shares we own in the portfolio are expected to rise 4% to USD 24.1m, only 5% lower than 2021’s record earnings, and for 2024 earnings are expected to grow by 16% to a new record level of USD 27.9m.

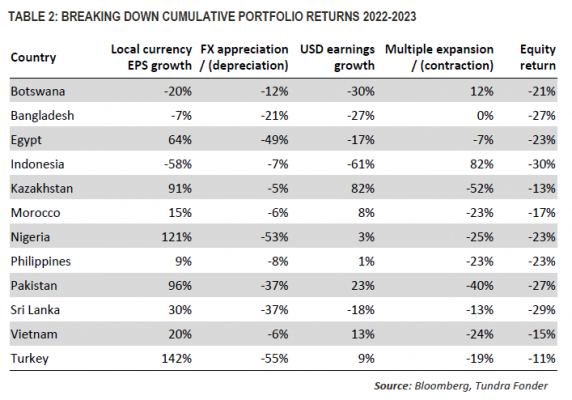

We’ve said it before, but it bears repeating – Equities are real assets. Currency movements can have a negative impact in the short term, but competitive companies raise their prices and work their way back to an acceptable return on invested capital. Companies need to plan for the future, which means new investments in fixed assets, and ensuring the personal development of their employees. Good companies thus recoup any lost margins relatively quickly. Our portfolio companies have again demonstrated their resilience. What has impacted the fund during the last two years is multiple contractions. Valuations have come down significantly due to investor concerns. Table 2 shows how the companies’ profits and valuations were impacted in 2022 and 2023, from profit generated in local currency, negative impact from devaluations, multiple expansion or contraction, and how this boiled down to returns (in USD) for each sub-portfolio at the country level.

As can be seen from table 2, despite significant devaluations in several countries, the companies have managed to keep up profits decently well in USD. What has driven the prices down is instead that valuations have come down significantly. Most of our sub-portfolios have become significantly cheaper. Valuations in Pakistan have fallen by 40%, in Vietnam by 24%, and in Kazakhstan (only one company though) more than halved.

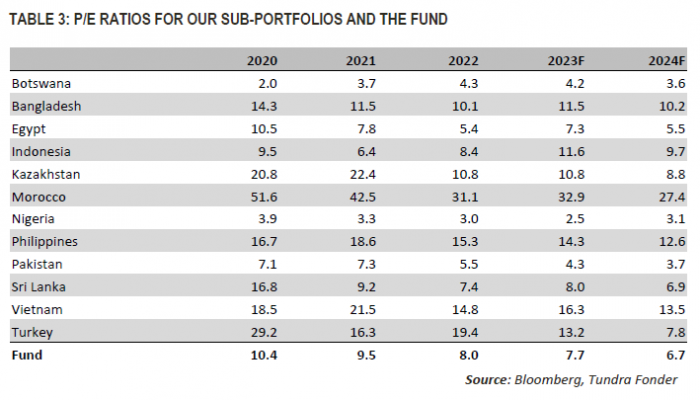

If we look at our current portfolio’s historical valuation, at the end of 2020, it was valued at 10.4x annual earnings and in 2021 at 9.5x annual earnings. For 2023 forecasted earnings, the valuation has come down to 7.7x, and for 2024 forecasted earnings at 6.7x.

The years 2020 and 2021 were far from ideal years. We had then had just under 6 years of a rather tough climate for smaller emerging markets behind us, and we were in a position where the longer-term effects of COVID-19 were uncertain. Food and commodity prices began to rise in the spring of 2021, making investors gradually more nervous. The assumption that valuations can at least return to these levels in the coming years thus seems realistic. Originating from 2023’s expected profits, this means an upside of 23-35% in the fund from current levels and 41-55% in 2024 based on forecasted earnings. One can argue for the sensitive situation that several of our markets are still in. There is a risk of more devaluations, continued subdued economic activity, and new risks may surface of course. But given that our markets have just gone through the worst crisis they have been through during the last 30 years, we have a recent outcome of actual impact on our portfolio companies in a worst-case scenario, and the outcome is not that frightening. As investors in emerging markets, and especially smaller emerging markets, one should always be prepared for surprises, but the likelihood of another crisis as bad as the one we are now emerging from is statistically low. Instead, post a severe crisis, there tend to be several relatively strong years, partly because of corporates operating in a more favorable environment, but even more so the changing perception of investors. Expectations are very low currently, whereas, in theory, they should be higher than they have been for several years.

______________________________________________________________________

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.