FUND PERFORMANCE

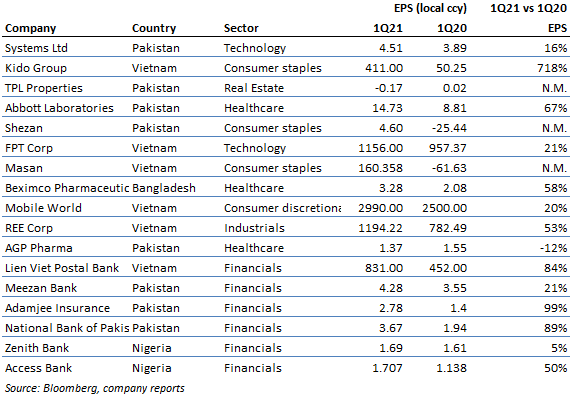

In USD the fund rose 1.0% during the month (EUR: -1.8%), compared to MSCI FMxGCC Net TR (USD) which rose 7.2% (EUR: +4.1%). In absolute terms, we received positive contributions primarily from Vietnam and Bangladesh, where the sub-portfolios rose 7% and 5% respectively during the month. We received negative contributions from Pakistan, where our sub-portfolio fell 5% during the month, and Egypt where the sub-portfolio fell 6%. Versus our benchmark, lack of holdings in Kazakhstan (the market rose 15%), Kenya (+10%) and Slovenia 12%) impacted relative performance negatively. Renewed Covid concerns characterized most of the Asian markets, where concerns about increased restrictions meant profit-taking among local investors which impacted our holdings. The headlines from India were frightening and we have seen significant increases in the spread of infection in Pakistan, Bangladesh, and Sri Lanka, although the countries’ healthcare systems have so far not been strained in the same way as in India. This meant that the strong quarterly reports that were released were overshadowed. During April, 16 of our holdings, corresponding to 43% of the fund’s assets, reported results for the first quarter (calendar year) and the results were generally slightly better than expected (see Table 1). So far, it is primarily our companies in Vietnam and Pakistan that have reported. Our countries followed a slightly different path last year. For Vietnam and Bangladesh, the first quarter was the toughest, while for Pakistani companies the second quarter was the hardest in terms of impact from COVID-19.

Five of our six largest holdings, corresponding to 32% of the fund’s assets, were among those that reported results for the first quarter (calendar year) 2021:

- Our largest holding, the Vietnamese IT company FPT corp, increased earnings per share during the first quarter by 21%. Sales rose 21% on an annual basis during the first quarter of the year.

- Our second-largest holding, Pakistani IT company Systems, increased earnings per share by 16%. As expected, a currency loss was booked during the quarter (80% of sales are exports and the Pakistani rupee strengthened 5% against the USD during the quarter). Adjusted for the currency loss, profit increased by 38% on an annual basis. Sales increased by 37% compared to the first quarter of 2020.

- Our fourth-largest holding, the Vietnamese bank Lien Viet Postal Bank, increased earnings per share by 84% during the first quarter. The result corresponds to 40% of the current full-year estimate.

- Our fifth-largest holding, the Pakistani bank Meezan Bank, increased its earnings per share by 20% during the first quarter of the year.

- Our sixth-largest holding, Ree Corp, which is Vietnam’s leading listed renewable energy company, increased profits by 62% during the first quarter of the year.

Among other company news, we were pleased to see that the Sri Lankan company Windforce, which focuses on solar, wind, and hydropower in frontier markets, was listed on the stock exchange. The share rose 13% from the introductory price. We now have just under 6% in renewable energy companies (in addition to Windforce, also Vietnamese Ree). It is an industry with strong structural growth that is so far very attractively priced in our markets. Both of our holdings trade below 10x expected earnings for this year.

Concerns about the increased spread of infection overshadowed the positive reports during the month. We can probably count on this remaining a factor that will occasionally worry local investors in our markets in the coming months as well, given that the availability of vaccinations is so far significantly worse than in the richer countries in the world. Unlike in 2020, however, there is now a definable problem with available empirical data on the impact on companies and our countries’ governmental actions. And even though one should respect the short-term impact from concerned investors, we are moving towards better times. Relatively soon, the focus should be on 2022 and more normal circumstances. We can not recall any time since the fund’s launch when we saw a more positive undertone among the portfolio companies. It is not primarily about how they are managing COVID-19, but more about the fact that we see the result of several years of adaptation work after several tough years. The fund is currently trading at 9.7x the current year’s profits and 7.7x for next year. Our companies operate in non-cyclical sectors subject to structural growth, their growth profiles are solid and the valuations are attractive. In our view, it is an excellent time to take the opportunity to accumulate exposure while covid-concerns continue to keep the enthusiasm in check.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.