PAKISTAN AND VIETNAM WEIGHED ON FUND PERFORMANCE DURING JULY

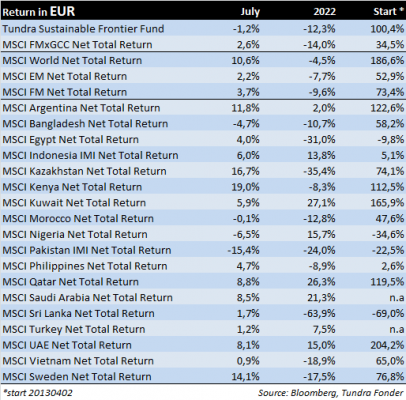

In USD the fund fell 3.5% (EUR: -1.1%) during the month, compared to our benchmark MSCI FMxGCC Net TR (USD) which rose 0.1% (EUR: +2.6%) and MSCI EM Net TR (USD) which fell 0.2% (EUR: +2.2%). Calculated in USD, it was primarily Pakistan (-2.5% absolute fund contribution), Vietnam (-1.5%) and Bangladesh (-0.6%) that contributed negatively. Indonesia (+0.7% absolute fund contribution), Kazakhstan (+0.3%), the Philippines (+0.3%) and Sri Lanka (+0.3%) moderated the decline.

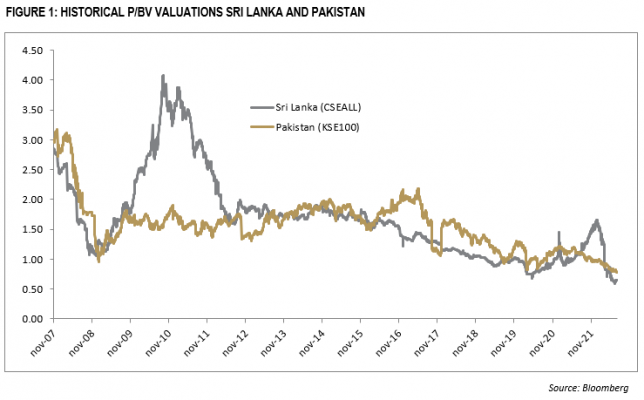

We’ll start with the main negative contribution during the month, which was Pakistan. The Pakistani rupee fell 14% against the US dollar, which was the currency’s worst single month since 1972. Since April 2021, when world commodity prices really started to pick up, the currency has now weakened 36%, which is more than during the global financial crisis (27%) and in line with the 2017-2019 decline (34%). The decline occurred despite Pakistan reaching an agreement in principle with the IMF in mid-July on the resumption of loan disbursements. A board decision at the IMF will of course be required (preliminary August 25th), but this is normally a formality. Instead, investors primarily focused on the risk that the increasingly weak government coalition that came to power in mid-April will not have the capacity to take the necessary decisions to ensure continued IMF financing, which in turn is important for Pakistan’s ongoing financing from friendly states (primarily China and the Gulf States). We see no signs of this given the series of tough economic decisions the government has already taken since the end of May. Pakistan has a long history of running into crises, but it has an equally long history of managing them, regardless of which party is currently in power. The political temperature will remain high and there is still a relatively high probability that we will see an early election (ordinary elections to be held before October 2023). However, we consider it unlikely that it will affect the country’s decision-making ability or its long-term relationships with important creditors (primarily China and the Gulf states). At the end of the month, the equity market (KSE100 index) was valued at 0.78x book value. This is 17% lower than at the bottom of the financial crisis (Jan 26th 2009). Fundamental levels say obviously nothing about the short-term development but are a good indicator of the long-term. The equity market has discounted a crisis far worse than can be justified based on the actions and preparations we have seen so far.

In Sri Lanka, the parliament voted for Ranil Wickremasinghe as the new president in July. For the disillusioned population, it is not an ideal decision as Wickremasinghe is also seen, not entirely fairly one must add, as part of the establishment that was behind Sri Lanka’s crisis. However, the most important thing for Sri Lanka now is to complete the negotiations with the IMF and complete the restructuring of the country’s external commercial debt. The timetable has been pushed forward somewhat given the turbulence in the country, but it is still reasonable to reach an agreement in the autumn, which should mean that the country can then look forward again. The currency has temporarily stabilized around levels of LKR/USD 360-365 vs 200 pre-devaluation, and during July the country showed its first trade surplus in 20 years. At the end of July, the equity market (CSE ALL index) traded at 0.65x book value. It is 39% lower than at the bottom of the financial crisis (December 30, 2008, in the case of Sri Lanka), which says something about current investor expectations. The important thing for the country is that it now looks ahead and focuses on getting the recovery right. The crisis has not changed the fact that Sri Lanka is one of our markets that has the shortest path to becoming an upper-middle class economy given the good level of education, the unique geographical location next to India, and the great potential of the service industry (including tourism) which is spread over a relatively manageable population size. Assuming nothing unexpected happens, the stock market should have seen the worst. How quickly the situation improves will be up to the people of Sri Lanka to decide.

In Bangladesh, the stock market fell 7% during the month. The country has mostly stayed out of the crisis headlines, given ample foreign exchange reserve, and stable currency. In the month of July, however, it announced that it intends to apply for IMF support to ensure stability in the short and medium term.

The highest contribution during July came from Indonesia where Media Nusantara rose 13%. The company’s split of the business into two separate parts, the Free-to-Air Television broadcast segment, and the digital business, is now beginning to be noticed by more analysts. The valuation of 5x expected earnings for 2022 is one reason. Another reason is that the company’s ownership in listed MNC Digital Entertainment, where the digital business is consolidated, is worth around 3x the market price of Media Nusantara at the moment.

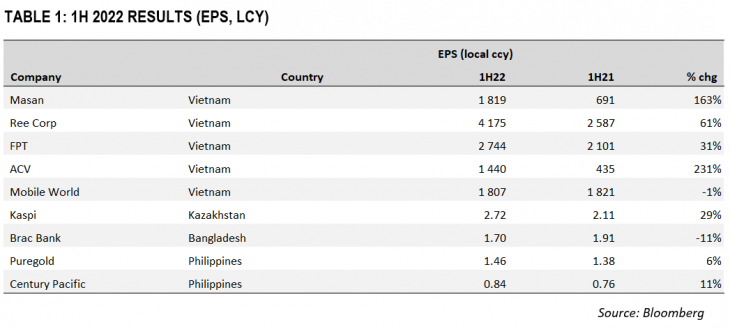

At the time of writing 39% (measured as percentage of AuM) of our portfolio companies have reported numbers for the first half of 2022 (calendar year). Overall, the reports were in line with expectations, with most of our holdings delivering positive profit growth (see table 1). The fund’s largest holding, the Vietnamese IT company FPT Corp, is worth noting in particular. In the first half of the year, the company’s revenue rose by 22% and earnings per share by 31%. Global IT services, which make up just under 50% of sales, increased revenue by 29%. Sales to the USA (+48%) excelled, which can also be seen as a positive signal for another of the fund’s larger holdings with a similar focus, Pakistani Systems Ltd, where the USA is the largest single market. We saw some signs of temporarily restrained consumption in both of our consumer-oriented companies, Masan and Mobile World. In Masan’s case, it is interesting to follow the company’s grocery chain, WinMart, which can now be considered to have passed the risky start-up phase. In 2022, roughly 200 small shops (7-eleven format) and 5 larger grocery stores have been added. In total, the company has reached 3 000 stores around Vietnam. The business now has a positive operating cash flow, which means that the expansion ahead becomes less risky. The modern grocery trade is still underdeveloped in Vietnam. Vietnam today has just under 100 million inhabitants, compared to Thailand’s 70 million. Thai CP All has roughly 12,000 7-eleven stores across and continues to expand with 500-600 stores per year. The continued execution of WinMart will be crucial, but the hardest part of a potential growth journey has probably been bypassed. Ree Corp, whose growth is primarily driven by the investment in renewable energy, is now the fund’s third largest position. During the first half of the year, the company showed a profit growth of 61% for the first half of the year, driven primarily by good development in the hydropower segment. That our airport operator Airports Corporation of Vietnam would show a strong recovery as flying resumes in Vietnam was less of a surprise. Outside our Vietnamese holdings, also Kazakhi Kaspi reported numbers for the first half year, which were slightly ahead of expectations, and a sign of strength given the turbulence in Kazakhstan early in the year. The share price rose 15% during July. Bangladeshi Brac Bank continues to suffer from the temporary lending rate cap (9%) in Bangladesh. In the pending discussions with the IMF, this might be one of the policy actions that need to be reversed, which would be positive. Philippine grocery retailer Puregold and food producer Century Pacific both managed to show marginal profit growth, despite the Philippine consumer being one of the harder hit so far in 2022.

Russia’s invasion of Ukraine has plagued the world in 2022. Those that have been hit the absolute hardest are low-income and lower-middle-income countries, where food expenses make up a large part of household income and where the majority of raw materials are imported. As an investor, you often end up in situations when you need to draw financial conclusions from political and economic events. How it affects the general business conditions for the countries in which you are invested, how this affects the individual companies, and eventually portfolio impacts. As investors, we are long-term but also very conservative. We have followed our markets for decades and have first-hand experience of the kind of difficulties they regularly go through. We select companies that have a history of successfully weathering the more difficult periods in our markets, we try to buy these when valuations provide a good margin of safety even in a worst-case scenario, and which in a normal business climate should provide a superior return relative to other investment opportunities. Foreign investors many times underestimate the ability of successful companies to navigate the often difficult conditions in our markets.

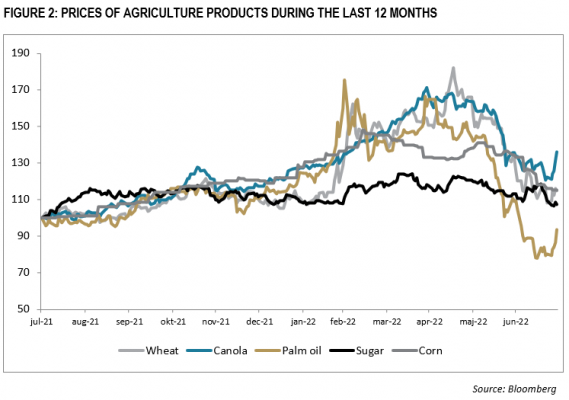

The best investment opportunities therefore often occur in a market situation when the majority of investors are still pessimistic and do not see any immediate change. As one great investor once said: “The most money is made when things go from truly awful to merely bad”. As a rule of thumb, you can say that the pessimism is usually at its peak about 6 months before you see actual improvements in the companies’ conditions. The difficult thing about the situation in Ukraine is, of course, that it cannot be judged as a normal cycle, since it is not possible today to determine the end of the conflict. Rather, in this case, it is currently about assuming that the world adapts to the new global situation, which includes a gradual replacement of the goods we have been used to receiving from Russia and Ukraine (it takes time), but also that we consume less of the goods that have become too expensive (so-called demand destruction), partly through efficiency but also by finding other goods or raw materials that fulfill the same function. Somewhat off the major headlines, the UN, Turkey, Ukraine, and Russia announced in July that Russia and Ukraine had reached an agreement to allow the export of agricultural products from the ports of Ukraine. We were a little surprised that the news didn’t have more impact. Perhaps it is a matter of rational skepticism regarding the endurance of such an agreement, which makes sense. Or it might be the fact that Turkey’s controversial president Erdogan taking center stage as one of the negotiators. Regardless, it is a positive signal and probably an important reason why the wheat price has fallen as much as 40% from the peak in mid-May (see figure 2). Among the possible scenarios for the long-term effects of the conflict in Ukraine, the probability of rational handling of the areas that do not directly affect the conflict itself should therefore not be excluded.

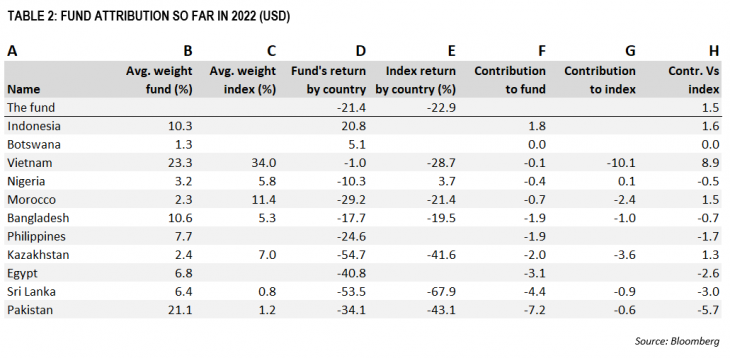

Although in 2022 the fund has returned in line with our benchmark, it has probably been the most challenging year since inception, given that a major crisis simultaneously hit a number of our markets particularly hard. Had we known before the year the course of events that would later unfold, we probably would not have expected to be ahead of the benchmark at the end of July. We therefore will spend a few words explaining how this was possible. The table to the right shows where the fund has made, and lost, money so far in 2022. In the financial world, this is called “Attribution”. The table is not complete as it only includes the markets we had exposure to during the year but shows the main events. Column A shows the fund’s average country weight during the year, column D shows the return in the respective country portfolios, and column E shows the index return for the corresponding countries. Column F shows the absolute contribution we received from each country’s portfolio (20% return on a portfolio that makes up 10% of the fund = 2%). As you can see from the table, most of the fund’s markets have had a rather poor year. It has of course been the most difficult for Sri Lanka, whose crisis management fell short of even our conservatively set expectations. Two of the markets we had the most faith in ahead of 2022, Pakistan and Egypt, have been hit hard by the rampant commodity prices. What alleviated the negative consequences are two parts. Partly our relatively new country exposure (since May 2020), Indonesia. Given that the country is a net exporter of raw materials, the stock market has fared well (+2% in USD during 2022). In addition, we have had the benefit of our stock selections working well with our sub-portfolio rising >20%. Relative index (column H), however, the biggest contribution is our stock selection in Vietnam, where the sub-portfolio has performed almost 30% better than the index since the turn of the year, resulting in a net contribution of almost 9% vs the index. The large performance differences between different markets are typical for smaller emerging markets and frontier markets. These are primarily driven by local investors who focus on their own country’s opportunities and problems. Putting together a number of them in a fund leads to diversification effects that lower the total risk in the portfolio, even during a catastrophic year like 2022.

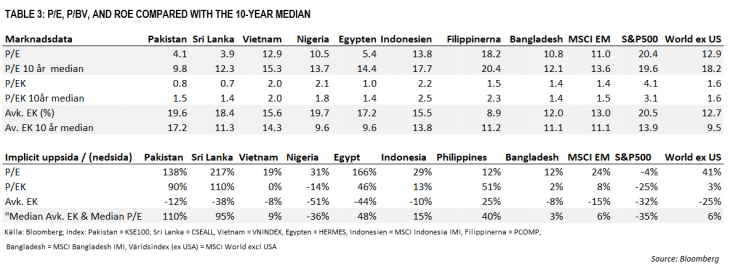

Looking ahead, we note that developed equity markets have moved higher since mid-June. Inflation concerns have decreased, partly replaced by concerns about recession. The risk of recession has meant that interest rates with longer maturities have moved downwards since mid-June and we have also seen a downward impact on commodity prices. Unsurprisingly, growth stocks, with the gains further into the future, have been the category of stocks that performed the strongest in the recovery. Smaller emerging markets and frontier markets have not joined the rally as the positive effects noted by investors in the US have not yet made themselves felt in this part of the world. The supply of necessary raw materials is still constrained and the raw materials currently consumed were bought at expensive levels during May and June. Economic austerity, eliminated subsidies, and discussions about the sustainability of poor countries’ debt levels, have continued to weigh heavily. Some countries, e.g. Pakistan and Sri Lanka, are in discussions with the IMF and the room for error is limited. For understandable reasons, the dominant investor base, local investors, remain quite weighed down by the gravity of the situation. The bond market with yields in most cases above 10% still feels like a safer haven. Provided that the lower raw material prices persist, however, the conditions for the majority of our markets should improve going forward. Given that purchases normally take place through 3-month contracts, we should be able to see some relief in our countries’ current account balances already in the coming months. Valuations are generally lower than their 10-year average and for the countries hardest hit by the crisis (Sri Lanka, Pakistan and Egypt) valuations are at levels rarely, if ever, seen in recent decades. July was a clear example of the lag of events, and how long-term fundamental improvements rarely translate immediately into a better market climate in our markets. One must respect the fear and need for certainty that is required. The nervousness will remain in the months to come. A potential new area of concern is China’s reaction to the recent visit of the US to Taiwan, but valuations are providing a significant margin of safety on the downside. It is hard not to be optimistic about the rest of 2022.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.