A STRONG COME-BACK FOR THE FUND

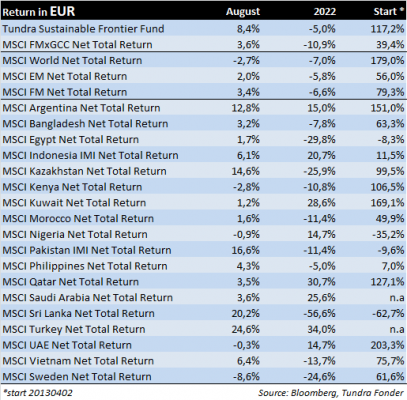

In USD the fund rose 6.7% (EUR: +8.4%) during the month, compared to our benchmark MSCI FMxGCC Net TR (USD) which rose 2.0% (EUR: +3.6%) and MSCI EM Net TR (USD) which rose 0.4% (EUR: +2.0%). Among individual countries, July’s loser Pakistan was the strongest absolute contributor in USD (+3.3% portfolio contribution; sub-portfolio rose 19%), followed by Vietnam (+2.3% contribution; sub-portfolio rose 9%), and Egypt (+0.7 %; sub-portfolio rose 9%).

Among individual stocks (USD), Pakistani Systems Ltd (+1.7% portfolio contribution; the stock rose 26%), Vietnamese REE Corp (+1.0%; +14%) and Pakistani Meezan Bank (+0.9%; +25%) stood out. Negative contributions were mainly from Indonesia’s Media Nusantara (-1.0% portfolio contribution; the stock fell 13% during August). Outside Media Nusantara, no stock negatively contributed by more than 0.1%.

Pakistan was at the center of events during August, for the stock market mainly for positive reasons. After weakening 15% against the dollar in July, the Pakistani rupee strengthened 8% in August. Investors were cheered by increased confidence that Pakistan would reach a new deal with the IMF, while the current account balance improved (relieving pressure on the currency). At the end of the month, the IMF subsequently confirmed the resumed loan disbursements. In combination with the stock market rising 5% in local currency, it was one of the better months for foreign investors in recent years. The floods in the country, which are the worst since 2010, are of course terrible from a societal perspective but have a marginal impact on the stock market. We expect a limited impact on our companies, which are mainly engaged in the service sector. In addition, none of our companies with production of goods have seen their facilities significantly affected at the moment. A purely cynical observation, based on many years of experience with these types of events is that they often lead to increased donations from abroad and reduced imports, something that improves the balance of payments. It is important here to distinguish between the humanitarian disaster and the crass economic impact. Our thoughts are with the impacted families. One concern going forward is the increasingly strained relationship between opposition leader Imran Khan and the Pakistani military after Imran Khan directly accused the military’s current leadership of helping to oust him as prime minister. For most of Pakistan’s population, the military historically has been seen as a stabilizing factor that stepped in when politicians misbehaved too much and ensured that the country still managed to move forward. At the same time, probably no politician has ever had as much popular support as Imran Khan has today. An interesting power struggle awaits.

Overall, it was a month in which several of the hardest hit markets so far in 2022 recovered. Sri Lanka was also among the winners with a gain of 18% (USD) following signs that an agreement in principle with the IMF is nearing. This was later confirmed on September 1, when it was agreed on a package of USD 2.9 billion, disbursed over four years. It should be noted that an agreement in principle sets the framework for a future loan package, but under the condition that certain criteria are met. Before payments are made, Sri Lanka must reach an agreement with its creditors regarding the restructuring of the country’s debt.

The majority of our companies have now reported and the reports have generally been in line with expectations. Among individual companies, one of our largest holdings, the Pakistani IT consultant Systems Ltd, deserves special mention. Given that roughly 80% of the company’s revenue is obtained in foreign currency, it has directly benefited from the currency weakening in Pakistan. During the first half of the year, turnover rose by 75% in local currency. If we take into account the weakened rupee, sales still increased by a whopping 47% in USD terms. Earnings per share rose 93% but were exaggerated by foreign exchange gains (which occur during periods when the rupee weakens). We have expected that the strong growth with aggressive recruitment would temporarily mean lower margins and we saw signs of this in the first quarter. During the second quarter, the operating margin rose unexpectedly again, which is surprising given the aggressive expansion the company is undergoing. During the first half of the year, the company added 400 employees and now has just under 5,600 employees. During the first half of the year, the company also carried out a strategically important acquisition of another leading Pakistani IT company, NDC Tech. The acquisition is expected to increase turnover by 10-15% over the next twelve months. We have followed Systems Ltd for 7 years and have probably rarely seen the management more comfortable with the prospects. We feel that the company has reached a point where its international competitiveness has been confirmed and the series of awards the company has received in recent years (not least the third year in a row on Forbes Asia: Best under a billion) means that they have reached a threshold where acquiring new customers is easier. At the end of the half-year, the number of active customers increased to 108, compared to 80 in the corresponding period last year. Systems Ltd may be Pakistan’s largest IT company, but from an international perspective, the company is still very small with a turnover of just over USD 100m. Having its base in Pakistan is a strong competitive advantage given good access to consultants at low cost, as well as the difficulties for smaller companies to reach out globally themselves. Provided that the management maintains the focus that has taken Systems to the position it is today, the company is likely still very early in a growth journey that should extend over decades from here. The valuation of just over 20x the current year’s consensus earnings remains low, given the strong growth phase the company is in. The fund’s overweight in the IT sector should be seen in the light of the fact that our holdings are all profitable, have proven their expansion capabilities, and have strong long-term growth prospects.

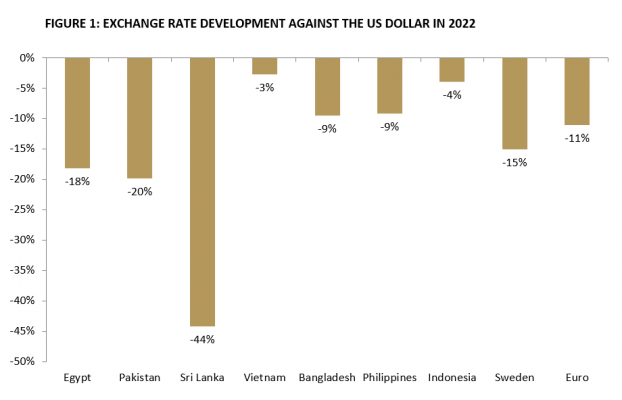

As you know, 2022 has been a difficult year that hit several of our markets hard. Three of our countries (Pakistan, Sri Lanka, and Egypt) have been forced into significant devaluations against the US dollar (Pakistan 20%, Sri Lanka 45%, and Egypt 19%). The rest of our larger countries have also seen their currencies weaken against the dollar. When talking about currency weakening, however, it should be remembered that the dollar has been strong against most currencies this year, as the table below shows. Both the euro and the Swedish krona have weakened significantly during the year, in fact, more than several of the currencies in the countries we invest in (see Figure 1).

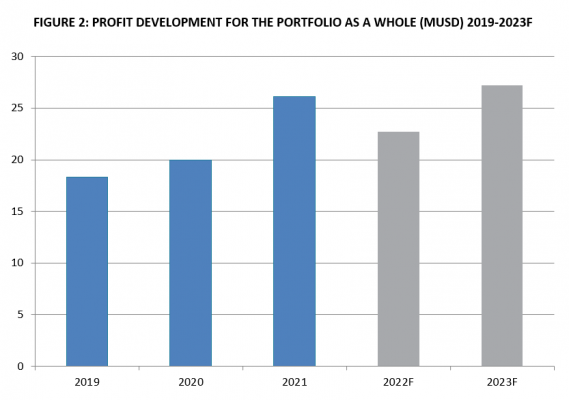

We frequently talk about the valuation of the fund as a whole. When we talk about the P/E ratio for the portfolio, we calculate this under the so-called “Harmonic P/E method”, which is the only correct way to determine a portfolio’s P/E ratio. This means that you take the number of shares you own in each company, multiply this by the profit per share and then get a total profit amount that can be compared to the assets under management. Example: If we manage USD 200 million and the sum of the profits (number of shares we own in each company multiplied by earnings per share for each share owned) is USD 20 million, the portfolio P/E ratio becomes 10, etc.

Doing this exercise based on the exchange rates for each market as of the end of August, we arrive at the total profits of the portfolio companies based on current forecasts falling by 13% in USD terms, from USD 26.5m to USD 22.7m during the current year (In euro they would be close to unchanged). Assuming these exchange rates remain constant as we then enter next year, profits are expected to rise 20% to USD 27.3m. The figure below shows the portfolio’s profit development in recent years pro forma (under the assumption that currently owned shares have remained unchanged during the period).

The assets under management of the fund at the end of August amounted to USD 207.2m. This means that the portfolio is valued at 9.1x the current year’s forecasted earnings and at 7.6x the next year’s forecasted earnings. Although we remain in a very difficult world situation and further disruptions can not be ruled out, one should recall that years like 2022 are historically very unusual. What one should remember is that provided that one owns shares in companies that can pass on price increases to the end consumer, shares are usually the most trustworthy long-term inflation hedge.

______________________________________________________________________

TUNDRA SUSTAINABLE FRONTIER FUND REPLACES THE SWAN WITH THE EU’S REGULATIONS FOR SUSTAINABILITY

In connection with the new EU regulation under the Sustainable Finance Disclosure Regulation (SFDR), new requirements are applied to funds’ sustainability work as of March 2021. Tundra has therefore decided on July 4 not to continue with the Nordic Ecolabelling of the fund. According to the new regulations, sustainability reporting must take place in a uniform manner and funds are divided into different categories. The Tundra Sustainable Frontier Fund is classified as an Article 8 fund (Light green: promotes environmental or social characteristics). The investment philosophy of the fund remains the same; management of the fund and is not affected by the change.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.