THE FUND CORRECTED AFTER A LONGER PERIOD OF STRONG PERFORMANCE

In USD the fund fell 5.3% in March (EUR: -4.1%), compared with MSCI FMxGCC Net TR (USD) which fell 1.4% (EUR -0.2%), and MSCI EM Net TR (USD) which fell 2.3% (EUR: -1.1%). Several factors explained the weak development. The fund lost about 3% absolute return in Sri Lanka and 2% in Egypt after both countries devalued their currencies during the month. We also lost about 0.5% in the Philippines, which is also one of the countries suffering the most from rising commodity prices. Positive contributions were received primarily from Indonesia (1%) and Vietnam (1%), where our stock selections worked well during the month.

After a longer period of strong performance we noted a sharp correction in March, which makes it natural to focus this update on what hit us during the month. In the previous monthly letter, we mentioned the risk of external pressures on some of our countries, but it unfolded a bit more dramatically than expected.

We were in Egypt during the days when the country chose to devalue its currency. The central bank noted increasing pressure on the current account given rising commodity prices. To facilitate this and reassure foreign investors in the local bond market, Egypt chose to allow the currency to weaken by about 15%. As they already had prepared foreign investments from the gulf countries in the order of USD 20-25 billion, the event became relatively undramatic. We view the action positively as it was well planned and properly executed.

Most of our meetings in Cairo took place after the devaluation and we note that the companies viewed the devaluation as positive given that there was some fear that Egypt would instead apply capital controls as we saw in the years after the Arab Spring 2011 until the autumn of 2016. The night before the announcement, we had dinner with the Deputy Minister of Finance who ruled out capital controls as an alternative, and the next day we understood why. Rising commodity prices, not least the price of wheat, which is an important part of the individual consumer’s shopping basket in Egypt, have caused some concern among foreign investors for a “new Arab spring”. We see the probability of this as minimal. Rising food prices were certainly one of the factors at the time, but there was also a long-standing and widespread dissatisfaction with the regime. Furthermore, the current government has learned from its mistakes. They now have much better instruments with large subsidies on food for the poorer part of the population to alleviate periods like this. Food subsidies will negatively affect the budget, but it seems like a reasonable investment to alleviate the suffering of the poorest sections of the population.

Perhaps the most interesting part of the trip was our visit to the new capital (working name: New Administrative Capital (NAC)) which Egypt is building less than 50 km from Cairo. The work has been ongoing since 2015. It is financed with land sales to local and international companies. NAC is a 20- year project that is eventually intended to house 6.5 million people (approx. 20 million live in Cairo today). When travelling in Cairo, we note the intense traffic and resulting congestions. After Dhaka (Bangladesh) and Lagos (Nigeria), Cairo traffic is the worst across our markets. In the first phase, all government buildings have been completed and before the summer, most of the country’s governmental departments will move into the new capital.

We met 16 companies during our days in Cairo; existing portfolio companies, some we have previously owned, but also some new acquaintances. It was a very interesting trip that generated a number of ideas. We will tell you more about this in future monthly letters.

Sri Lanka’s devaluation was much more dramatic. In relation to the size of its economy, Sri Lanka has held large loans in foreign currency, which required a continuous inflow of foreign currency in order not to cause concern. The country has been hit extremely hard by the absence of tourism since 2018. Then, tourism revenues accounted for just over 5% of the country’s GDP and were in a strong growing trend. Unfortunately a number of events occurred that derailed the economic growth after that. The Easter attack in 2019, claiming 269 lives, destroyed that year’s tourist season and when this was followed by Covid-19 in 2020, Sri Lanka ended up with a very strained balance of payments situation. The growth-oriented government that took office in 2019 refused to go to the IMF for support, as this would have put limitations on their expansive fiscal policy. It was hoped that tourism would resume before the situation became acute. Attempts were made to bridge the balance of payments through import restrictions and, since the summer of 2021, more extensive capital controls. However, Covid-19 and its variants lasted longer than they expected. When the recent commodity price hit global markets in the wake of the Russia/Ukraine crisis Sri Lanka had no choice but to let the currency float. Unlike in Egypt, this took place in an uncontrolled manner without prior financial support packages being secured. Combined with the pent-up demand for hard currency it caused panic in the market and has led to the currency weakening far beyond any REER-model would imply. The anger locally is understandable and massive protests are ongoing. The usual “sigh of relief-reaction” in the equity market post a devaluation has not materialized. Instead, the equity market has declined further.

The public confidence in the Rajapaksa brothers (Mahinda – Prime Minister, and Gotabaya – President), is severely damaged and will be hard to repair. If we zoom out and take the longer perspective, Sri Lanka is one of our countries with the best preconditions to show long-term stable current account surpluses. Firstly it has a unique advantage as a growing high-end tourist destination. Secondly, the long-term growth prospects of its service sector are very strong given its strategic location next to India and the availability of deep seaports. We sometimes refer to the country as “the next Singapore”. First, however, they need to pass the current hardship though. The first step is a likely restructuring of its Eurobonds and bilateral debt, followed by an IMF agreement. The former can be imminent while the latter most likely hinges on the success of debt restructuring.

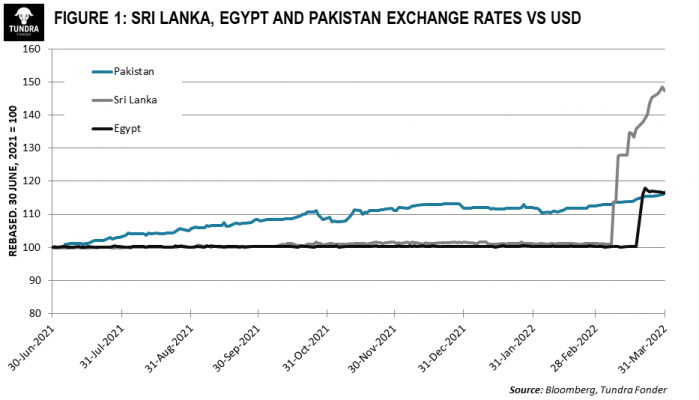

Another of our markets, Pakistan, has also been at the centre of attention. Like Sri Lanka and Egypt, high commodity prices have hit the country hard. Unlike Sri Lanka and Egypt, the country has not tried to maintain a stable exchange rate but has let the market price the rupee. Since the rise in commodity prices began almost a year ago, the currency has thus weakened gradually with the weakened current account balance (see Figure 1 on the next page).

As investors, we prefer market determined currencies as they act as cushions in times of overheating and lessen the risk of sudden disturbances to our companies’ planning. However, this means that Pakistan has been one of the first countries where consumers have felt the pain of rising inflation and the central bank has raised the key interest rate by 2.75% in the last nine months to 9.75%.

The opposition has taken advantage of the growing dissatisfaction locally and in March requested a no-confidence vote against incumbent Prime Minister Imran Khan (PTI). The vote should have taken place on April 3rd, but the deputy speaker rejected it due to alleged involvement of foreign powers (a US diplomat is alleged to have suggested to a Pakistani diplomat that the US would prefer if the vote of no-confidence was successful and Imran Khan removed from office). There is a disagreement between the government and the opposition as to whether the decision is in accordance with the constitution and the case is currently before the Supreme Court. If the court approves the parliament’s handling new elections are to be held within 90 days. If the court agrees with the opposition new elections might be delayed by a few months but it is hard to see the opposition being able to clinge on to power until the next elections in 2023, given the public outrage that would create. With the uncertain political situation, early new elections is the best outcome for the stock market. The opposition’s support has certainly been strengthened during the crisis, but it is highly doubtful whether it would give them a majority in parliament if there was an election today.

Imran Khan’s party PTI came in as a new political force in 2018 and broke the dominance of the two political dynasties (PML-N and PPP) in previous decades. Khan made promises to eradicate corruption and create a welfare state for the entire population. His absolute strength is that a majority of the population, even among the opposition, sees him as incorruptible and honest. The reforms that Khan has managed to implement so far are impressive, especially given the difficult economic situation he inherited and the crises that have subsequently affected the world. Khan’s idealistic side, however, remains his weakness. He has consistently refused to make compromises with the parts of the political establishment he believes have damaged the country historically, but insisted on prosecution and justice. He also has a frosty relationship with the United States given his criticism of the war in Afghanistan and that he asserted Pakistan’s right to self-determination in its foreign policy. It is therefore not surprising that the opposition took the opportunity to try to get rid of him under the prevailing circumstances. Assuming there are new elections and that Khan’s PTI wins the election, our hope is that he has learned from some of his political mistakes during his first term and focuses on looking ahead, rather than undoing history.

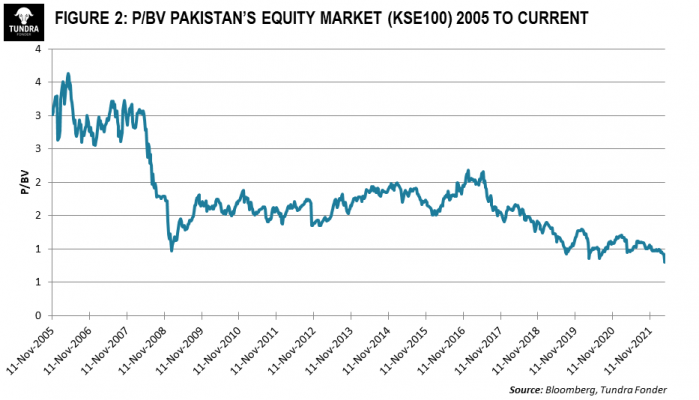

The stock market has been negatively affected by the economic and political uncertainty for a long time and is currently trading at record low levels, two standard deviations below its 10-year average both on P/E and P/BV (see Figure 2). Measured in P/BV, it is actually the case that the stock market is now trading lower than during the country’s absolute worst crisis (Global financial crisis) in 2008. It can of course get worse in the short term, but a lot of negativity is priced in by the market, which has gone through a number of tough years.

After a long period when the fund defied most of the concerns around the world, we got to experience a month where we also had to absorb our share of impact. We usually say that every year one of our markets is hit hard. Now there were two markets in one month and also political unrest in a third.

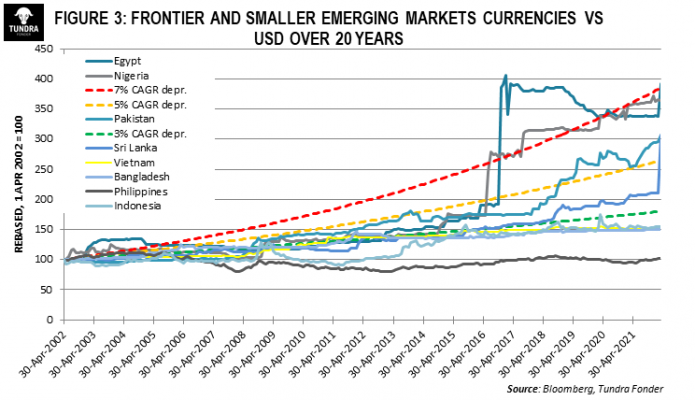

Although devaluations such as those we saw in Egypt and Sri Lanka can have short-term negative effects on the portfolio, in the longer run they are merely bumps in the road. A property or machinery is a real asset that carries about the same value in foreign currency regardless of the local exchange rate (steel, cement and long-shelf-life-products have a world market price). Normally, a devaluation is thus followed by a period in which companies adjust their pricing to return to a sufficient return on invested capital. The one-off downwards adjustments of sharp currency movements thus usually mean a good long-term buying opportunity. The impact at company level varies, however, and choosing the right company is, as always, important. As an average across all our markets, our countries’ currencies have weakened by around 4% per year against the US dollar over the last 10 years.

Some of our countries have been impacted less, others more. An important component of our analysis is thus how well a company is adapted to the conditions of its specific market. We either want to see that their market position is strong enough to pass on increased costs to the consumer, but there are also examples of companies that directly benefit from a weaker exchange rate. In for example Pakistan, almost 40% of our Pakistan sub-portfolio (and 8% of total fund) is an IT company (Systems Ltd) whose revenues are 80-85% based in foreign currency, while 85% of the costs are in local currency. In the case of Systems, they are thus significantly favoured in the event that the Pakistani rupee should weaken further, while at the same time enjoying significant volume growth also in a more stable climate.

We live in uncertain times and until we get a solution to the Ukraine/Russia situation, the world will be affected in phases and it’s hard to call long-term winners and losers. In the coming months, we will have a clearer picture of how global companies have been affected, but we already know that this will involve both increased input costs and logistical problems (difficulties in accessing essential goods in production). This year the Middle East in particular is a winner given its large energy exports. Tundra’s focus on low-income and lower-middle-class countries means that we haven’t had and will not have any investments in that region. We don’t invest in the fossil fuel sector, and rarely in cyclical industries where the pricing of their products is outside the company’s control. During the second half of 2021 and so far in 2022, that has been to our disadvantage, although well masked by good stock selection. It should be remembered, however, that Russia’s actions have triggered an intensive search for alternatives to the current energy supply chains. A change, which in the end is likely to permanently lower (demand destruction) demand for oil and gas. A recent example is Germany’s proposal to replace parts of its Russian natural gas with hydrogen from Australia instead. The production of so-called Green hydrogen, in turn, is completely dependent on a significant expansion of renewable energy. The painful process the world is currently going through will in the long run pave the way for a positive and sustainable development. This will result in interesting business opportunities which we believe we are well positioned to take advantage of.

As we concluded earlier, it’s still very difficult to evaluate the short and long term impact of the war in Ukraine, but we remain optimistic about the future in our markets. The aggregated portfolio is trading on reasonable 9.2x FY’22 expected earnings, and 7.8x FY’23E. That means an estimated profit growth of 15%, a very comfortable level for the vast majority of our holdings.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.