STRONG RELATIVE RETURN FOR THE FUND – NEW POSITION WITH 100-200% UPSIDE

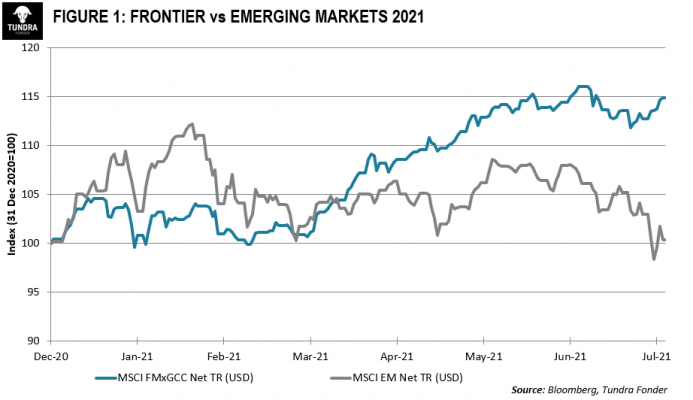

In USD the fund rose 2.3% (EUR: +2.2%), compared with MSCI FMxGCC Net TR (USD) which fell 0.6% (EUR: -0.6%) and MSCI EM Net TR (USD) which fell 6.7% (EUR: -6.8%). So far this year, the fund has risen 19% in USD (EUR: +23.1%), compared with MSCI FMxGCC Net TR (USD) which has gained 14.8% (EUR: +18.8%), and MSCI EM Net TR (USD) which has gained only 0.4% (EUR: +3.8%). The large difference in return with MSCI EM is a reminder that Tundra’s markets constitute a good diversification in an emerging market portfolio (see Figure 1). MSCI EM has fallen sharply recently due to concerns about the Chinese authorities’ actions towards, above all, Chinese technology companies. Even if we fail to see the logic that China ultimately wants to stifle its technology sector, it is a reminder to emerging market investors that China accounts for almost 40% of the main index.

In absolute terms (USD), we received our largest positive contributions during the month from Vietnam (1%), Pakistan (1%), and Bangladesh (+0.5%). None of the stock markets really excelled. Measured by MSCI’s country indices (USD), Vietnam fell 6%, Pakistan fell 3% while Bangladesh rose 3%. Instead, it was our stock selections that worked well during the month. In Vietnam, the consumer conglomerate Masan Group rose 22% ahead of the report that came out at the end of July. The fund’s second largest holding, the IT company FPT Group, also rose 7% during the month. In Pakistan, the fund’s largest holding, the IT company Systems Ltd, rose another 10%. Our second largest Pakistani holding, Meezan Bank, rose 6%. In Bangladesh, one of our smaller holdings, the API manufacturer (API = Active Pharmaceutical Ingredient, i.e. the active ingredient of medicines) Active Fine Chemicals, jumped 40% without any particular underlying news. The largest negative contribution during the month (-0.4%) was received from Indonesian Media Nusantara, which fell 14% after being excluded from the IDX30 index and concerns that increased restrictions in Indonesia would adversely affect advertising sales.

During the month, we divested our remaining position in Sri Lankan Commercial Bank. The position has for some time been below 1% of the fund’s assets, which means that we should either increase the position or sell it. Although we believe that the company is undervalued, we found that the relative potential in our other holdings is more attractive and we therefore decided to divest.

In recent months, we have gradually built up a slightly larger position (4% of the fund) in the Pakistani bank National Bank of Pakistan (NBP). The investment falls under something we would call a “special situation”. The bank is one of Pakistan’s largest banks but has over the last 20 years been notoriously mismanaged and plagued by recurring corruption scandals. With the new government in place, however, a new management for the bank has also been appointed. In our conversations with management, we make the assessment that the restructuring plan forward is honest and feasible, which should lead to a significant improvement in profitability. In addition to organizational problems, the bank has been burdened by a pension liability to former employees which has been the subject of a number of lawsuits in recent years. The potential cost if NBP loses corresponds to almost the entire bank’s market capitalization at present (approximately 60% after tax) and thus has a significant impact on the bank’s capital base. This risk has made the bank uninvestable for most investors over recent years. For several years however, the bank has not given any dividends but focused on increasing its capital base in order to be able to pay the amount in the event of losing the lawsuit. The bank is now approaching a situation where the buffer is large enough for them to be able to pay the full amount and still have a sufficient capital base. This means that we believe that the bank will resume the dividend within 12-24 months, even if it loses the pension lawsuit.

The bank has historically distributed between 60-80% of the profit. As NBP is currently traded at around 2.5x the annual profit, a normal dividend yield should be between 24-32%, not taking into account any profit growth. This is 2-3 times higher than the average of the dividend-paying banks. NBP is an extremely problematic company with a deplorable history. Furthermore, the fact that the company is state-controlled means that the work of streamlining the bank is politically sensitive and the management is regularly brought before a court. Recently, e.g. a group of investors tried to disqualify current management based on technicalities. However, we believe that the new government has decided to make the bank something Pakistan again can be proud of. Even if there will be setbacks along the way, we believe we will see a fundamentally changed corporate culture and thus significantly improved profitability in the future. The potential ahead should be compared to an already extremely low valuation (P/BV 0.3x, P/E 2.5x), in addition combined with a clear trigger for revaluation (resumption of dividends). We therefore see the position as a “special situation” with a potential revaluation of 100-200% over the next 24 months. We have conservatively expected the bank to lose the pension lawsuit. In the unlikely event they win the case, the revaluation potential will of course increase further. This at the same time as the long-term downside is very limited, even if we were completely wrong in our assumptions. NBP is a good example of when, based on our ESG analysis, we act on the basis of a will to improve and the potential that comes with it, rather than a company’s history and where they are today.

Regarding our market view for the coming month, we see no fundamental changes. Not entirely unexpectedly, the concern about COVID-19 is greater in all our markets, given the continued low vaccination rate. However, this is an expected problem and from a stock market perspective, it also means expectations that real interest rates will remain lower than historically. This is positive for equities. For the world as a whole, we note that a growing problem tends to be the reluctance to get vaccinated, which will affect the recovery. This is not unexpected either. For emerging markets as a group, the IMF’s new support package, which is expected to be distributed in August, is likely to have a positive impact on the risk appetite of global investors in emerging and frontier markets as it means a good addition to many countries’ foreign exchange reserves, e.g. Pakistan and Sri Lanka (> 10% of current foreign exchange reserves). We do not believe in a doomsday scenario for China’s technology sector, but note that combined with already existing geopolitical tensions it could mean some investors seek diversification into emerging markets outside China. This should also have a positive effect on our markets, where expectations of foreign inflows are modest nowadays and valuations remain attractive. The reporting season for the second quarter (calendar year) kicks off during the month of August and our analysis indicates that there are opportunities for continued surprises relative to the estimates. Overall our view of our markets remains constructive.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.