THE FUND

The fund fell 1.2% during the month, compared to the MSCI Pakistan IMI Net TR (SEK) benchmark index, which fell 3.4%. In August, the main positive contribution accrued from our underweight in index-heavy equities in the energy sector, but also from our exposure in Materials (primarily cement and steel). Among individual holdings, International Steels (+30%), Kohinoor Textile (+21%) and Pioneer Cement (+ 19%) performed strongly. No major portfolio changes were made in August.

MARKET

Even though the market was down almost 10% in the middle of the month, the market only fell 3.4% in August as a whole.

During the month, the Kashmir conflict dominated the headlines with India closing down all communication in the state in early August and subsequently abolished Jammu and Kashmir’s self-determination. At the time of writing, the telephony and internet connection is shut down in the area. India’s actions are controversial as the actions appear to be in conflict with a previous UN resolution. Kashmir has a complicated past and has historically been the reason for several armed conflicts between Pakistan and India. Pakistan’s version is that the Muslim majority itself should have the option to either decide its affiliation or to become independent. India, on the other hand, claims legal rights to Kashmir in accordance with the agreement that the former Maharajah of Kashmir struck with India in 1947. India also claims that Pakistan actively destabilizes the region by supporting terrorist activity, something Pakistan denies. India has now close to 1 million soldiers in the area (vs a population of 11m) and has been frequently criticized for its harsh treatment of the region’s mainly Muslim residents. With that being said, it is difficult to see a solution in the foreseeable future.

The ruling BJP party in India, with its right-wing nationalist background, will find it difficult to back down from the decision and to convince the people of Jammu and Kashmir of their new affiliation. India has been severely criticized by human rights organizations, but most major countries, apart from China, have been content to call for dialogue with Pakistan on the issue. There is a great risk of unrest in Kashmir when India is eventually forced to open up communication routes and India has blamed such incidents on Pakistan in the past. As late as February 2019, India sent fighter jets across the border to, as they put it, “strike a terrorist cell” on the Pakistani side of the border. In connection with this, Pakistan shot down an Indian fighter aircraft but returned the pilot a week later. We see it as unlikely that the case will develop into a full-scale military conflict. It should be borne in mind that the conflict over Kashmir has been going on for over 70 years and that the parties over the last 30 years have almost daily exchanged fire across the border. Despite the rather cautious comments from world leaders, the UN Security Council put up Kashmir on the agenda on August 15, and there are strong international interests that the situation will not deteriorate further. We believe that the situation will remain tense for a long time to come and there is a significant risk that we will also see temporary escalations (like in February), which can temporarily affect the stock market.

Otherwise, the news flow in August was primarily about the state of the economy. The fiscal year 2019 budget deficit (July 1, 2018 – June 30, 2019) was revised up from 7.2% to 8.9% and the deficit excluding interest payments amounted to 3.5%, compared to the 0.6% IMF- target for fiscal year 2020. This may mean that further savings measures need to be initiated, or we may see additional revenue measures introduced (privatisations or taxation). Our impression, from what we see on the ground, is that the slowdown in the economy looks to be even harder than expected. This will complicate the tax revenue target for the current tax year and will have a negative effect on the companies’ sales and profits in the short term. On the other hand, this means that the current account deficit is likely to decrease more than expected as a result of lower imports, which probably also means that inflationary pressure in the economy and thus interest rates will fall more rapidly than previously expected. If we look at the interest rate curve in Pakistan, there are expectations of a further 100 basis points rise in the next twelve months. It may be an overly pessimistic forecast.

Further on, most of the companies reported during the month. If we look at the companies that are included in the KSE100 index, consolidated profits fell 5% on an annual basis during the last 12 months. Sectors such as cement, steel, pharmaceuticals and consumer goods have been hard hit in particular, while the energy sector, power sector, fertilizer sector, and the financial sector have seen their profits rise and balanced up large parts of the losses. We conclude that last month’s winners were found among the hardest hit sectors, like cement and steel, despite results that were generally worse than expected.

In parallel with the discussions about the state of the economy and the impact on the companies, a lot of discussions locally is centered around the flows in the stock market and specifically the large redemptions from local equity funds in recent months. While foreign investors so far this year are net buyers in the order of USD 70m (though net sellers in August with USD 3m), local equity funds have been net sellers of USD 190m so far this year (of which USD 34m in August). Locally, there has been a shift from the equity market to the fixed income market, given the high interest rates. The size of the redemptions is unusual and we should have seen the bulk of it. However, this is another reason why it also would be positive to see the shorter maturities interest rates come down.

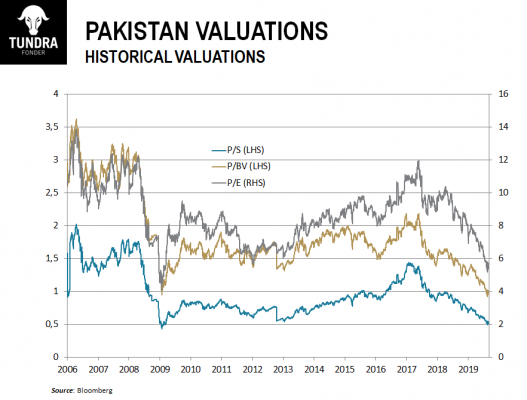

In the short term, uncertainty remains in the market. We have a number of quarterly reports before we can expect an improvement in the cyclical sectors. For a sustained turnaround, we also need to see that outflows from local equity funds dry out, or that foreign investors further increase their purchases. Furthermore, Kashmir remains a cause for concern, which will occasionally create unpleasant headlines. September 8-10, a Pakistan delegation meets FATF (a global authority that combats money laundering and terrorist financing) in Bangkok ahead of FATF’s October decision on Pakistan’s progress on combating money laundering and terrorist financing. The main scenario is that Pakistan remains on the “grey list” and is given more time to address remaining problems. Should Pakistan be removed from the grey list, it would be welcomed by the market. Should Pakistan however be moved to the “black list” it would be received negatively. As mentioned previously, we are very optimistic about the equity market from a valuation perspective. Regardless of which valuation measure you like to use; we find that we hover around historical lows (see attached image) and historically this has led to strong returns on a couple of years horizon. As George Soros once said: “The most money is made when things go from terribly awful to just awful”.

DISCLAIMER: Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is OpenFunds Investment Services AG, Seefeldstrasse 35, 8008 Zurich, whilst the Paying Agent is Società Bancaria Ticinese SA, Piazza Collegiata 3, 6501 Bellinzona, Switzerland. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.