THE FUND:

How Frontier Markets could look next year.

During June, the fund dropped 0.6% while the fund’s benchmark MSCI FMxGCC Net TR (SEK) fell 4.0%. The lack of Argentinian holdings was the main reason for the outperformance. Argentina, which accounts for 20% of our benchmark, fell 20% in June and has now fallen 40% (SEK) since the turn of the year. Egypt also contributed to the fund, and our positions in Ezz Steel and Obour Land rose 15% and 7% respectively. However, we lost relative returns in Pakistan, Sri Lanka and Vietnam totaling about 1.5%. No new holdings were added during this period; however, six holdings were divested. Unilever Nigeria was sold after a relatively short holding time, as a sharp rise relative to the market meant that the alternative returns in other investments were considered to be significantly higher. Five smaller holdings (Vingroup, Vincom Retail, Richard Pieris, CT Holdings and Renata) were sold. None of the holdings represented more than 0.5% of AuM. In the case of CT Holdings, the capital has been reallocated to their main asset, Cargills Ceylon, which is listed. In accordance with our goal that each long-term position should represent at least 1% of the fund assets, the choice was between increasing the positions or divesting them. In the case of these companies, we chose the latter option. Looking forward, it is hard to not be optimistic. So far this year, we have delivered a positive return of 7.9% after full fees compared with the benchmark that fell 7.0% during the same period. The benefit of our active management style was apparent from our decision to completely exit Argentina, the largest index constituent, late last year and earlier this year.

Our positive return so far during the year is largely due to good stock selection in Egypt, which we believe is still in an early recovery after the catastrophic years 2011-2016. At the same time, we conclude that investor expectations regarding Pakistan are approaching levels last seen when we launched the Tundra Pakistan Fund in the fall of 2011. Pakistan’s elections in July signal uncertainty, however, this uncertainty is very well priced in the stock market and we look forward to the next twelve months. In 2018, we increased our positions in Sri Lanka, which used to be a very small market for us. Sri Lanka has transformed from being one of the most expensive frontier markets to the cheapest (excluding Pakistan) measured in P/E-ratios. We have also significantly increased our positions in Nigerian bank shares, which we believe are heavily undervalued relative to future earnings growth. We exited the larger blue chips in Vietnam early and our portfolio of mid-cap companies in the country is now valued on average to just below 9x annual earnings after having fallen as much as the market as a whole. Looking ahead, we see a good upside here. On a consolidated basis, the Fund’s P/E-ratio is currently 9.4x annual earnings for 2018. The expected high-profit growth in the portfolio companies means that the valuation for 2019 is expected to fall to 7.8x annual earnings. We hold, almost exclusively, companies targeting domestic markets, therefore our exposure to Trump’s potential trade war is limited. While there will always be risks ahead it is rare that these risks have been so well discounted in the valuations of the companies we own.

THE MARKET:

June was another turbulent month in frontier markets. Our assessment shows that the second quarter of 2018 has actually been the weakest since the fourth quarter of 2008, in the midst of the financial crisis. Argentina was the main reason for the weak performance. In fact, Argentina has lowered the return on MSCI FMxGCC Net TR (SEK) by 13% so far this year (15% in USD). If we exclude Argentina the benchmark’s return would have been around 6% in SEK, but unchanged in USD.

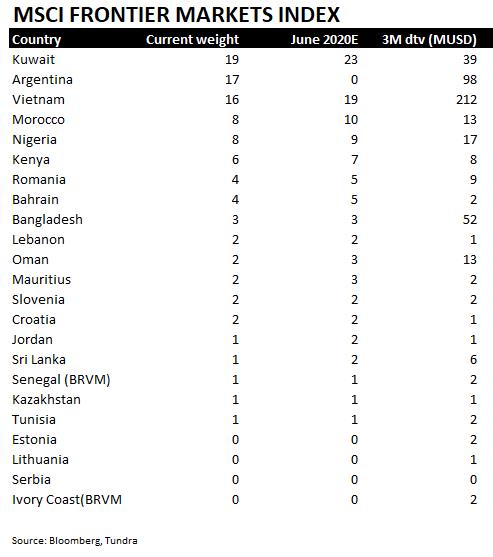

On June 7, Argentina announced that it had brokered an agreement with the IMF on a USD 50 billion support package. The package was slightly higher than suggested by the rumours preceding the announcement. Subsequently, on June 20th, MSCI upgraded Argentina from the Frontier to the Emerging Markets category. This means that Argentina’s last day in the Frontier Markets category will be May 31st, 2019. As of June 1st, 2019, the country will be considered part of the MSCI Emerging Markets, where it is expected to gain a weight somewhere between 0.3-0.5% (compared with about 15% in MSCI FM and 20% in MSCI FMxGCC). The Argentine stock market rebounded temporarily but fell again. The currency continued to fall and dropped another 8% from the announcement of the IMF agreement. Provided that inflation does not shoot up further from the approximately 25% expected for 2018, the major fall in the Argentine peso should be behind us (28-29 per USD vs. approximate consensus of 30-35 as fair value). What is now being priced in is most likely an upward adjustment of the political risk premium in the country. Argentina plans to hold national elections in autumn 2019. It is likely that reform-oriented Mauricio Macri’s popularity will fall further, as a result of the recent economic downturn. Argentina has a history of currency controls. It is probably no coincidence that MSCI said that it would only include depositary receipts (Argentinian shares traded outside of Argentina) among the index constituents. Regarding MSCI’s index changes, we also conclude that the largest index market in MSCI FM, Kuwait, was placed on a watchlist for an upgrade to EM. A positive decision might come as early as June 2019 (in which case inclusion may take place in June 2020). Vietnam was not placed on the watch list but we think it likely that this will happen next year with an eventual inclusion in MSCI EM in June 2021, at the earliest.

We published a report on the forthcoming changes in MSCI FM just over a year ago. In which we discussed how the index may change in the coming years. The numbers have changed slightly, as have the timings, but the main conclusions remain unchanged. In the report, we theorised that within a few years the index would become a, somewhat, unattractive collection of odd and illiquid markets, and frontier managers would be more likely to invest outside of MSCI’s countries described as Frontier Markets. However, for Tundra, these changes are immaterial. Our definition of a frontier market is an abandoned or undiscovered market, with a large population and whose economy comes from a low base. Our seven core countries (Vietnam, Bangladesh, Pakistan, Sri Lanka, Egypt, Kenya, and Nigeria) have an average population of 100 million people and a GDP/capita of less than USD 3,000. Our choice of countries is thus thematic and not dependent on whether MSCI labels the market as “Frontier” or “Emerging.” For example, at present, nearly 40% of the fund is committed in countries identified by MSCI as Emerging Markets (Pakistan and Egypt). In the coming years, we anticipate that the boundaries between EM and FM will be even more blurred and, other frontier managers will begin to adopt Tundra’s investment approach, which we pioneered more than 5 years ago.

ESG ENGAGEMENT:

No new companies were added to the fund in June.

CT Holdings PLC, Renata Limited, Unilever Nigeria PLC, Vincom Retail JSC and Vingroup JSC were divested this month due to financial considerations.

Richard Pieris & Co. was divested from the fund mainly due to governance concerns in connection with the departure of several independent directors from the company’s board; and difficulty in engaging with the company. While we made some headway in initiating dialogue with the company’s senior management, their response rate was less than satisfactory. As a result, we were unable to formulate a strong enough conviction regarding the long-term outlook of our investment, leading to our decision to divest.

DISCLAIMER:

Capital invested in a fund may either increase or decrease in value and it is not certain that you be able to recover all of your investment. Historical return is no guarantee of future return. The state of the origin of the Fund is Sweden. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3,3bis and 3ter CISA. The representative in Switzerland is ACOLIN Fund Service AG, Affolternstrasse 56, CH-8050 Zurich, whilst the Paying Agent is Bank Vontobel Ltd, Gotthardstrasse 43, CH-8002 Zurich. The Basic documents of the fund as well as the annual report may be obtained free of charge at the registered office of the Swiss Representative.

Kundgrupp / Investortype:

* Ontario and Quebec